- 1.91 MB

- 2022-04-29 14:10:34 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

'12June2019AsiaPacific/JapanEquityResearchTechnologyTechnologysectorResearchAnalystsCOMMENTHideyukiMaekawa81345509723AsiaFeedback(Semiconductor/SPE):Noreboundinhideyuki.maekawa@credit-suisse.comAkinoriKanemoto3Q;slumpworseningregardlessofHuaweisanctions81345507363akinori.kanemoto@credit-suisse.com■Summary:WeconductedourregularsurveyoftheAsianmarketbetweenlateMikaNishimuraMayandearlyJune.Thesurveybeganaweekaftersanctionswereimposed81345507369onHuawei,sotheentiresupplychainwasindisorder.But,evensettingthatmika.nishimura@credit-suisse.comaside,semiconductordemandwaslackluster(seeour12Junereport,AsiaYoshiyasuTakemurafeedback(Huawei),fortheresultsofourHuawei-relatedsurvey).Thereare81345507358yoshiyasu.takemura@credit-suisse.comessentiallynoexpectationsforareboundinoveralltechnology-sectormarketSayakaShimonishipricesin2H2019.Positivedevelopmentsweremuted,butincludedthe81345507364following:(1)anaccelerationofdevelopmentoncombinedmodem/APchipssayaka.shimonishi@credit-suisse.comfor5Gsmartphonemodels;(2)asuddenrecoveryincryptocurrencydemand;(3)increaseddemandinChinaforinverterairconditioners,IoT-enabledappliances,andsmartgasreaders,(4)concretebusinessdiscussionsrelatedtoTSMC’sinvestmentsinmassproductionusingthemostadvancedprocess;(5)300mmCISproductionremainingatfullcapacityatamajormanufacturer.Negativefactorsincludedthefollowing:(1)thedominoeffectofsuppliersrevisingsettlementtermsasaresultofbalance-sheetdeteriorationamongChineseautomakersspreadingfromTier-1supplierstosalesagents;(2)Chinesesalesagentsremainingextremelycautiousintheirinventorymanagement;(3)therecoveryindatacenterdemandslowing,puttingserverDRAMatriskofbecomingunprofitable;(4)NANDmanufacturers’attemptstoraisepricesbeingrebuffed,andsmartphoneNANDpriceincreasesbeingunlikelytosucceeduntil2Q2020owingtointensecompetition;(5)expectationsthatexcessinventoriesofDRAM/NANDwillnotbeworkeddownbyend-2019;and(6)investmentsinmemoryprocessmigrationbeingpostponedorcanceled,aswellasexpectationsofcautious2020capexplans.■Investmentimplications:Weremainbearishonthetechnologysectorasawhole.WeexpectsharepricestocorrectinadvanceofresultsannouncementsbyglobalmanufacturersinJuly,astheseannouncementsarelikelytoexacerbatethelackofexpectationsforarecoveryindemandin3Qand2H2019.WhilethereisupsiderisktosharepricesrelatedtoUS-ChinatradefrictionandHuawei-relatednegotiations,unlesstherearesomekindoftop-leveltalksbetweentheUSandChinaattheG20summit,wethinkthatinvestorswillsubsequentlypricetheriskofguidancecutsinto2H2019intoshareprices.WethinktheentireSPEsectorisatriskofloweringguidancein2HFY3/20,andinparticular,webelievethereisdownsidesharepriceriskformemory-relatedfirmsTokyoElectron(8035)andAdvantest(6857),aswellasTokyoSeimitsu(7729),TOWA(6315),andJapanMicronics(6871).Conversely,weupgradeAnritsu(6754)fromNeutraltoOUTPERFORM.WethinkAnritsuwillbenefitfromchipmakersacceleratingdevelopmentoncombinedmodem/APchipsfor5Gsmartphonemodels.DISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.

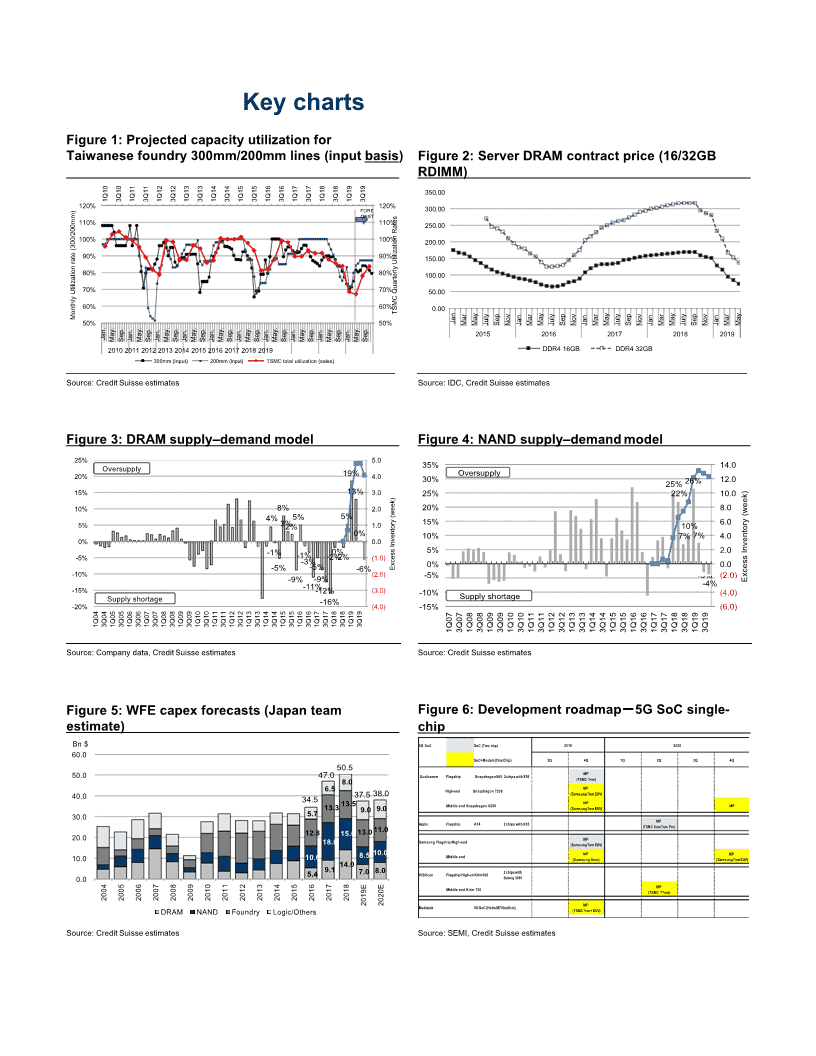

KeychartsFigure1:ProjectedcapacityutilizationforTaiwanesefoundry300mm/200mmlines(inputbasis)Figure2:ServerDRAMcontractprice(16/32GBRDIMM)350.0013131313131313131313120%QQQQQQQQQQQQQQQQQQQQ120%10101111121213131414151516161717181819FO19RE300.00CAST110%110%250.00Ra100%100%te200.00s(30090%90%/2raU150.000teti0m80%80%liz100.00amti)onU70%70%Q50.00tiuliazrtati60%60%e0.00orlTynMSo50%50%MJaMMJSNJMMJSNJMMJSNJMMJSNJMMnthCnaaulyepoanaaulyepoanaaulyepoanaaulyepoanaalyr2y015vr2y016vr2y017vr2y018v201r9yJaMSJaMSJaMSJaMSJaMSJaMSJaMSJaMSJaMSJaMSn.ayepnayepnayepnayepnayepnayepnayepnayepnayepnayepDDR416GBDDR432GB20.10.201.12.01.22.01.32.014.20.15.20.16.20.17.201.82.01.9...........300mm(Input)200mm(Input)TSMCtotalutilization(sales)Source:CreditSuisseestimatesSource:IDC,CreditSuisseestimatesFigure3:DRAMsupply–demandmodelFigure4:NANDsupply–demandmodel25%5.035%14.0Oversupply19%Oversupply20%4.030%26%12.025%15%13%3.025%22%10.0)ke10%8%2.020%8.0ew4%5%5%(w(y5%3%2%1.0ee15%10%6.0rkto0%)10%7%7%4.0ne0%0.0Inv-1%-1%0%ve5%2.0In-5%-2%-2%(1.0)ns-3%to0%0.0s-5%-5%-6%ryEec-10%(2.0)xc-5%-3%(2.0)x-9%-9%eE-11%ss-4%-15%-12%(3.0)-10%(4.0)SupplyshortageSupplyshortage-16%-20%(4.0)-15%(6.0)778899001122334455667788990000001111111111111111111113131313131313131313131313131313QQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQ131313131313131313131313130000000000001111111111111111111144556677889900112233445566778899Source:Companydata,CreditSuisseestimatesSource:CreditSuisseestimatesFigure5:WFEcapexforecasts(JapanteamFigure6:Developmentroadmap-5GSoCsingle-estimate)chipBn$5GSoCSoC(Twochp)2019202060.0SoC+Modem(OneChip)3Q4Q1Q2Q3Q4Q50.550.047.0MPQualcommFlagshipSnapdragon8652chipswithX55(TSMC7nm)8.06.5High-endSnapdragon7250MP37.538.0(Samsung7nmEUV)40.034.513.5Middle-endSnapdragon6250MPMP13.39.09.0(Samsung7nmEUV)5.730.0MPAppleFlagshipA142chipswithX55(TSMC5nm/7nmPro)11.012.815.013.020.0MP18.0SamsungFlagship/High-end(Samsung7nmEUV)10.68.510.0Middle-endMPMP10.0(Samsung8nm)(Samsung7nmEUV)14.09.17.08.02chipswith5.4HiSiliconFlagship/High-enKirin9900.0Balong5000456789012345678EEMP00000011111111190Middle-endKirin730(TSMC??nm)000000000000000122222222222222220022MPMediatek5GSoC(HelioM70built-in)DRAMNANDFoundryLogic/Others(TSMC7nm+EUV)Source:CreditSuisseestimatesSource:SEMI,CreditSuisseestimates

TableofcontentsKeycharts2Investmentsummary5Investmentimplications......................................................................................................5Valuationtables...................................................................................................................6Executivesummary8Noteworthymarketfeedback.............................................................................................8NormalizationofsurplusDRAM/NANDinventoriestoextendbeyond2019;2020capexplanslikelytobeflatYoYacrossmemorysector...............................................9Logic,foundry,andCIStrends11Ourviewbasedonoursurvey........................................................................................11Semiconductorcapacityutilization.................................................................................117nm/5nmproductionanddevelopmentatTaiwanfoundries/KoreanLSImakers14Chinasemiconductorsandrelatedmaterials................................................................15CISmarket/productiontrends..........................................................................................15DRAMmarkettrends18Ourviewbasedonoursurvey........................................................................................18DRAMmarketoutlook......................................................................................................18DRAMdemandoutlook....................................................................................................20DRAMsupplyoutlook.......................................................................................................24DRAMinventorytrends....................................................................................................24DRAMpricingoutlook.......................................................................................................24Secondgenerationofhighbandwidthmemory(HBM2)demandtrends..................26NANDmarketoutlook27Ourviewbasedonoursurvey........................................................................................27NANDmarketconditions..................................................................................................27NANDdemandoutlook.....................................................................................................28NANDsupplyoutlook........................................................................................................323DNANDmassproductionanddevelopment..............................................................36Front-endSPEmarket38Ourviewbasedonchannelchecks................................................................................38Back-endSPEmarketoutlook43Ourviewbasedonoursurvey........................................................................................435G45Ourviewbasedonoursurvey........................................................................................45

Otherareas47Cryptocurrency..................................................................................................................47Automotive.........................................................................................................................47Chinesesalesagencies...................................................................................................47Other(IoT,homeappliances,securitycameras,etc.)................................................48

InvestmentsummaryInvestmentimplicationsOtherthantheHuaweiSemiconductor-related:SentimentinChinaverypoor;excessmemoryinventoriesissue,weseenonotexpectedtobeconsumedbyend-2019,outlookfor2020likelytobecautiousparticularchanges;riskofTheHuaweisanctionshaveputthesupplychainindisarray,butsettingthataside,thereadjustmentinChinesewerenomajorchanges(forbetterorworse)intheproductionoffinishedhardware.smartphoneoutputSemiconductorcapacityutilizationisrecoveringslowly,risingfrom71%in1Qto79%in2Qand83%in3Q,andalthoughmarketprices,arerebounding,thisrecoverylacksmomentum.OngoingsluggishnessWithregardtodatacenterinvestment,excessinventoriesathyperscalecustomersshouldindata-centerdemandbeworkeddownbyJul–AuginthecaseofDRAM(reflectinga1–2monthpostponementofcompletion)andsometimein2QinthecaseofNAND.Amonghyperscalecustomers,therecoveryindemandislikelytoslowstartingin3Q,andamongDRAMmanufacturers,serverDRAMbit-rategrowthforecastsforthefull2019arelikelytobelowered(from+25–30%to+15–20%).Thebit-rategrowthforecastforenterpriseSSDsisunchanged(+30–35%).Forthatreason,excessinventoriesofbothDRAMandNANDarenotexpectedtobeconsumedbytheendof2019,andinventoriesarelikelytoremaininexcessin1H2020owingtoaseasonalslumpindemand.Inotherwords,DRAMandNANDmarketpriceswillprobablynotturnarounduntil2H2020,sothecurrentcorrectionislikelytobeunprecedentedlylong.EvenifmanufacturersweretocutNANDoutput,itwouldhelptoreduceinventoriesbutnottoimprovemarketprices.EvenintheChineseautoindustry,wheretaxbreaksareexpectedtostimulatedemand,expectationsforareboundarenotrisinginthesupplychain,whiledemandforsemiconductorsandcomponentscontinuestofallbyaround20%YoY.Therearealsonosignsofarecoveryintheirdemandforecasts.AmongsalesagentsinChina,sentimentisextremelypoor,andtheyaremaximizingtheirinventorymanagementbyholdingoffonprocurement.Demandisrisinghereandthere,includinginthecryptocurrency,smartmeter,airconditioner,andIoT-enabledappliancefields,butthisisunlikelytobecomeacatalystboostingsemiconductormarketprices.SurveybeliesbusinessAccordingly,foroperatingcompaniesexpectinga2Hrecovery,themarketenvironmentisoperators’statedworsethanexpected.WeremainbearishonJapanesesemiconductormaterialsandexpectationsfor2Hmemorycompanies(Toshiba(6502),SUMCO(3436),Shin-EtsuChemical(4063),JSRpricerecovery;weak(4185),andTokyoOhkaKogyo(4186).OnlySony—whosemanufacturingfacilitiesaresentimentinChineseoperatingatfullcapacitythankstotheshifttomulti-cameraphonesandtohigher-marketresolutionCISs—isbuckingthistrend.SPE-related:Memoryinvestmentbeingsuspendedorcanceledin2019,outlookfor2020reinedin,TSMC’Sleading-edgeprocessinvestmentprovidingupsideMemory-makerMemorymanufacturers’appetiteforcapexisdecreasingfurtherowingtosuchfactorsasinvestmentlikelytobetheriskofserverDRAMbecomingunprofitableandthelikelihoodthatexcessDRAMandflatin2020NANDinventorieswillnotbeworkeddownbytheendof2019.Historically,theyhaveincurredcapacitylossesasresultofinvestinginprocessmigration(DRAM/NAND)andincreasedlayercount(NAND),buthavecompensatedforthisthroughcapex.Butincreasingly,suchcapexisbeingsuspendedorcanceledoutright.Moreover,USmanufacturers(mainlyNANDmakers)whoarenowunabletoshipproducttoHuaweiowingtothesanctionsarecancelingtheircapexplans.EvenSamsungElectronics,whichalwaysmakesmassiveinvestments,hasapprovedNANDcapexbuthaslimitedsuchinvestmentto$0.5–1.0bntofocusmainlyonefficiencygains.Memorymakershavenoplanstoaccelerateinvestmentin2020.IflocalChinesememorymakers,whichhaveyettofinalizetheircapexplans,decidenottoinvest,overallinvestmentwilllikelybeflatYoY.

Firmfoundrytrends;Foundries’leading-edgeprocessinvestmentplansarelikelytobelargelydeterminedby5nm,7nmexpansionprocessselectionforthenew2020iPhonemodelAP.However,businessdiscussionsplannedin2Hhavemoremomentumnowthatthreemonthsago,and5nmprocessand7nmprocessinvestmentislikelytobeincreaseto30,000unitsandbyanadditional30,000units,respectively.SomeofthenewiPhonemodelsfor2020arelikelytouse5nmEUVprocesschips.Forthatreason,foundrycapexislikelytoremainhighin2H,withnodropoff.Inback-endassemblySPEinvestment,thereislikelytobeshort-termdemandrelatedtoHuawei,butexcludingthis,investmentremainslackluster,includingasaresultofinvestmentcancelationbyUSmemorymanufacturers.Consequently,wethinkJapaneseSPEcompanieswhoseforecastsarepremisedonarecoveryin2HFY3/20(TokyoElectron,SCREEN(7735),Advantest,TOWA)areatriskofguidancecuts.Whileessentiallyremainingbearishonourcoverageuniverseinitsentirety,basedoncautiousmemoryinvestmentin2020andmajorfoundryinvestment,ourorderofpreferenceisnowSCREEN>Disco(6146)>TokyoElectronandAdvantest(inourpreviousreportofthreemonthsago,ourpreferenceorderwasDisco>TokyoElectron>SCREEN>Advantest).OurorderofpreferenceformidSPEisJOEL(6951)>Lasertec(6920)>TokyoSeimitsu(7729)>Ferrotec(6890)>TOWA>MicronicsJapan>NuFlareTechnology(6256)(inourpreviousreportofthreemonthsago,ourpreferenceorderwasJEOL>Lasertec>TokyoSeimitsu>Ferrotec>TOWA>NuFlareTechnology>MicronicsJapan).ValuationtablesFigure7:Semiconductor/SPEvaluations(asof11June)ClosingPrice:06/11/19Price:MktPriceEPSEV/EV/AbsoluteperformanceRelativeperformanceDvdYldROEPBRNetD/ESalesEBITDA%%CapCurTP%toTPCSEPSP/E,xCompanyCodeRating3/183/193/203/183/193/203/193/193/193/193/193/19JPY,bnJPYJPY%1M3M12M1M3M12MAE1E2AE1E2%%xxx%IECHitachi6501RESTRICTED3,9084,045470.5478.3506.28.68.58.02.512.11.00.43.0-0.19.820.2-1.99.122.110.7Toshiba6502NEUTRAL1,7843,3953,150-7.21628.91738.8182.61.92.018.60.083.51.10.48.2-46.9-5.8-5.86.4-6.6-3.919.0MitsubishiElectric6503OUTPERFORM3,0351,4152,24058.3113.8120.1129.112.411.811.02.511.21.40.54.8-25.3-4.64.7-9.4-5.46.63.2NEC6701OUTPERFORM1,0674,1104,70014.4308.0365.8400.413.311.210.32.29.91.10.45.210.67.66.635.26.88.547.8Fujitsu6702UNDERPERFORM1,5527,6554,900-36.0711.1567.8677.110.813.511.32.611.11.60.45.0-2.85.00.612.24.32.624.8SemiconductorRenesas6723OUTPERFORM8835221,280145.246.335.437.028.414.714.10.010.41.41.03.1-17.5-7.4-5.3-54.2-8.2-3.3-41.6NetworkEquipmentAnritsu6754OUTPERFORM2481,8082,12017.365.586.392.527.620.919.61.412.32.51.911.6-29.25.5-16.717.94.7-14.830.6SPETokyoElectron8035NEUTRAL2,61115,97513,400-16.11245.51340.31025.416.111.915.64.226.83.01.86.8-46.0-4.48.2-22.2-5.110.1-9.6SCREENHoldings7735NEUTRAL1924,1055,70038.9608.6626.8747.216.06.55.53.816.01.00.53.5-17.2-16.6-5.3-54.8-17.3-3.4-42.2Disco6146NEUTRAL60316,79015,200-9.51035.7860.0876.822.219.519.13.014.42.73.210.0-47.3-4.015.6-17.6-4.817.5-5.0Advantest6857UNDERPERFORM5682,8731,860-35.3102.0242.5108.821.911.826.42.626.12.61.56.8-76.1-3.617.314.8-4.419.227.4JEOL6951NEUTRAL1172,3991,830-23.7100.9116.4128.123.820.618.70.413.42.61.112.521.86.124.63.95.326.516.6NuFlareTechnology6256UNDERPERFORM847,0404,600-34.7763.4356.4595.59.219.811.82.15.71.10.73.1-77.111.717.9-9.911.019.92.8Lasertec6920OUTPERFORM1883,9804,0000.596.8108.5255.132.236.715.61.017.15.96.023.6-22.9-13.3-6.910.7-14.1-5.023.3TOWA6315OUTPERFORM208091,730113.8121.0119.6134.312.06.65.92.510.20.50.31.8-19.60.422.4-38.4-0.424.3-25.8MicronicsJapan6871UNDERPERFORM39972870-10.548.441.248.215.423.019.62.06.61.20.74.0-40.813.233.3-8.912.435.33.7TokyoSeimitsu7729NEUTRAL1112,6584,44067.0306.4357.3332.814.07.48.04.314.41.00.83.2-32.6-10.4-1.2-36.6-11.20.8-23.9Ferrotec6890NEUTRAL338801,800104.577.1150.8152.834.75.85.82.711.20.70.74.464.7-18.4-7.7-58.5-19.1-5.7-45.8SUMCO3436NEUTRAL3691,2581,180-6.2199.7138.8103.96.19.112.14.913.71.21.34.015.8-7.61.0-51.3-8.33.0-38.7Shin-EtsuChemical4063NEUTRAL3,9169,42010,56012.1726.0769.3806.612.812.211.72.512.81.41.54.3-43.1-0.51.5-15.2-1.33.4-2.6JSR4185OUTPERFORM3621,6512,18032.0149.3164.6170.216.010.09.73.69.10.90.75.1-2.84.1-6.0-18.83.3-4.0-6.1TokyoOhkaKogyo4186NEUTRAL1553,4303,300-3.8164.9135.1172.417.925.419.93.53.91.01.06.3-26.61.510.5-18.50.712.4-5.9Source:ThomsonReutersDatastream,CreditSuisseestimates

ygloeorn:hecucreuoigTSnFos-3-2-11234em00000000so%%%%%%%%erhTnto:acersMICRONICSJAPAN8pste,JEOLauemQUALCOMMJyaReTOWAgtrsHITACHIlotaaTERADYNEoDSHINKOnNUFLARETECHNOLOGYhDISCOceitADVANTESTtderIBIDENCeMEDIATEKsAPPLIEDMATS.isuNASDAQsSKYOCERAkeNIDECccLAMRESEARCHontASMLHOLDINGasTOKYOELECTRONmAPPLErNECofSONYrMITSUBISHIELECTRICe’pHIROSETEXASINSTRUMENTSTAIWANSEMICON.MNFG.JAPANAVNS.ELTN.IND.MINEBEAMITSUMI3BROADCOMmSHIN-ETSUCHEMICALorSOXXntheSAMSUNGELECTRONICSvsoTOPIXELECTRICAPPLIANCEStoCIRRUSLOGICckeSUMCOrheSKHYNIXtutFUJITSUrnsaNIKKEI225STOCKAVERAGEspALPINEELECTRONICSePIONEERerGLOBALWAFERSshTOKYOSEIMITSUthtTOPIXnKLATENCORoLASERTECTOSHIBAmSCREENHOLDINGSJAPANDISPLAYQORVOTAIYOYUDENNIKONNISSHAPRINTINGSKYWORKSSOLUTIONSSEAGATETECH.PANASONICTDKNGKSPARKPLUGCASIOCOMPUTERINTELSHARPJVCKENWOODALPSCITIZENHDG.ANRITSU2e1MURATAnuSEIKOHOLDINGSJ9SILTRONIC1WACOMWESTERN02DIGITAL7

ExecutivesummaryNoteworthymarketfeedback■Byprocess,7nmand12nm/16nmlinesarerunningatfullcapacityatTaiwanesefoundries.■Cryptocurrency-relateddemandisrecovering(~10kwpm).SamsungElectronicshasreceiveditsfirst-everordersfor8nmchipsforBitmain’sAntminer.■ResolutionoftheIntelCPUshortageintheChinesemarketwasdelayedtoApril2019.■Commercializationofsingle-chip5GSoC(5Gmodem+AP)isbeingbroughtforward.SamsungElectronicsplanstobeginsupplyingits8nmExynoschipin2H2019,andMediatekandQualcommplanreleaseswithinthisyear.■QualcommisusingTSMC’s7nmprocessforitsSnapdragon865forflagshipsmartphonesandSamsungElectronics’7nmEUV-basedprocessforitsSnapdragon7250/6250forhigh-endandmidrangephones.■ServerDRAMislikelytobreakevenin3Qandturnintolossesin4Q.■RecoveryinserverDRAMdemandweakerthananticipatedbyDRAMmakers,spurringthemtoconsiderprioritizinginventoryreductionsoverprofitabilitymaintenance.■DRAMmakershaveloweredtheirforecastsforbitgrowthinserverDRAMin2019,fromgrowthof+25–30%asofMarchto+15–20%recently.■UptakeinCooperLakeprocessorsforservershasbeenslow,sowenowexpectthemtogaintractionin2020insteadof2H2019.IceLakeshouldbereleasedin2H2020(previously2Q2020).■USdatacentersarerefurbishingend-of-life(EOL)eSSDforreuse,anditseemsthatasupplychainforresaleintheChinesemarketisupandrunning.■NANDwaferpricesseemtohavebottomedat$0.05–0.06/GB($1.6–1.9for256GB).Prices(midpoint)areroughly25%downfromMarch,implyinganOPMworsethan−50%.■NANDmakerscontinuetopushforpriceincreases,withplanstoraisepricesforNANDwafersin3Q,cSSDandeSSDin4Q,andeMMCandeUFSin2Q2020.■SPEmakersarereceivinginquiriesfromTSMCregardinglineexpansiontoroughly30Kfor5nm-processmassproduction.InstallationisplannedfromAugust2019,followedbyaramp-upto50KfromJuly2020.■TSMCtargetsa30–35Kcapacityramp-upfor10nm,7nmand7+nmprocessescombined.Itisalsomullingincreasedoutputof16nmand12nmchips.■Samsunghasapparentlyapprovedaninitialinvestmentof$0.5–1.0bnintheXianPlant’sFab2(X2)facility.■SomeAPmakersforecast5Gsmartphoneshipmentswillincreasefromabout10mnunitsin2019to120–150mnin2020and250mnin2021.■Facedwithdeterioratingfinances,Chineseautomakershavelengthenedpaymenttermsmore.Thisislikelytohaveknock-oneffectsonpaymenttermsthroughoutthesupplychain.■TherearesignsofstrongerdemandforIoTmodulesusedinsmartmeters(gasutilities)andNB-IoT-compliantmeters.

NormalizationofsurplusDRAM/NANDinventoriestoextendbeyond2019;2020capexplanslikelytobeflatYoYacrossmemorysectorRiskofChineseEvenexcludingtheimpactofHuaweisanctions(seeourAsiaFeedback(Huawei)reportsmartphoneoutputpublishedconcurrently),semiconductorsupplychainsshownosignsofrecoveryinadjustments,evenhardwareproduction—asdiscussedinourconcurrentlypublishedAsiaFeedbackwithoutHuaweiissue;(Hardware)report.InChina,smartphonesalesweresluggishinApril,butsmartphonesluggish,withproductionhasyettodeviatefromexistingproductionplans,posingariskofproductiondownsideriskascutbacksfromJuly.WithChina’srecentVATcutfailingtostimulateautomotivedemandChinesedistributorsamidwidespreadcreditconcerns,semiconductordemandcontinuestodeclineata~20%takecautiousapproachYoYpace.Inresponsetothemurkydemandoutlook,localChinesesemiconductortoinventorydistributorsareplacingutmostpriorityonparingdowninventoriesinsteadofactivelymanagementbuildingthemup.TaiwanesefoundriesAmidsuchweaknessinsemiconductordemand,Taiwanesefoundries’capacityutilizationoperatingatfulltiltforappearstoberecoveringnonetheless,drivenlargelybyrecoveryin300mmproductionofcuttingedge7nm,chipsforflagshipandhigh-endsmartphonesaswellasatransientproductionincrease12nm,and16nmrelatedtotheHuaweisanctions.Specifically,weexpectthesefoundries’capacityprocesses;lowutilizationnumberstorecoverto79%in2Qand83%in3Qafterhittingalowat71%in1Q.utilizationratesforThemarketwasexpectingsemiconductorinventorydestockingonthewholetobe28nmandoldercompletedbyJune,butitnowlookslikelytocontinueuntilJulyorAugust.Theleading-processesedge7nmprocessandthe16/12nmprocessesareoperatingatfullcapacity,reflectingsoliddemandforflagshipsmartphonemodels.Smartphonemakersareexpeditingdevelopmentofcombinedmodem/APchipsfor5Gmodels.Suchchipsareslatedtoentervolumeproductionstartingin4Q2019.Leading-edge7nmprocessesareconsequentlylikelytomaintainhighcapacityutilization.RiskofserverDRAMInthememorysubsector,datacenterdemandhasbeenslowtorecover.Intel’snewlossesemergingasCascadeLakeCPUshavenotspurreddemandforserverDRAM,whosepricesaredownearlyasend-3Q25%in2Q.Furtherpricecutsarelikelyin3Qalso.DRAMmakershavestartedtoawakentotheriskofsub-breakevenserverDRAMpricingfromlate3Q.ThesemakershavebeenplacingpriorityonDRAMinventorydestocking,butwenowseeanincreasedlikelihoodthattheymayshifttoprofitability-focusedstrategiesfrom3Q.Assuchashiftwouldentailsupplycurtailment,DRAMmakerswouldnotbeabletoentirelyclearouttheirserverDRAMinventorysurplusesbyyear-end2019.TheNANDmarketisalsobesetbyaseveresupplyglutandexcessinventories.ProductioncutswillreduceNANDinventoriesovertime,butgivenprevailingweaknessindemandforhigh-memorysmartphonemodelsandtheunusuallylargeNANDinventorysurplus,weseenoprospectofthesurplusbeingfullyeliminatedbyend-2019.WithbothDRAMandNANDinventorysurpluseslookingincreasinglylikelytopersistbeyondyear-end,webelievememorymakersareturningcautiousintheirpricingoutlookfor1H2020aswell.WedoubtDRAMpriceswillhalttheirfallbymid-2020.Meanwhile,NANDmakersfacecontinuedcustomerresistancetotheirattemptstoraiseprices.WeexpectthesemakerstocontinuetosellwafersandattempttoraisecSSDandeSSDpricesin3Qandbeyond.CompetitiontosupplyNANDforsmartphonesisfierce,virtuallyrulingoutpriceincreasesasfaroutas2Q2020inourview.Wedonotanticipateamarket-widebottominNANDpricesuntilmid-2020attheearliest.Memory-makerWehearthatmemorymakershaverevisedtheir2H2019capexplansandareformulatinginvestmentlikelytocautiouscapexplansfor2020inresponsetotheDRAM/NANDinventoryglutsandremainlowin2020ongoingmargindeterioration.AbsentaconfirmedbottominbothDRAMandNANDpricesby2Q2020,capexwilllikelybedepressedin2020.Wehavelongassertedthatinventoriesareanimportantdeterminantofthememorycapexoutlook.Weexpectthetimingofinventorynormalizationtoagainprovetobealeadingindicatorofarecoveryinmemorycapex.

Foundriesplan5nm,Meanwhile,foundriesarestartingtoinvestinvolumeproductionprocessesatthe5nm7nmexpansionprocess.Applehasapparentlydecidedatlastonthechipspecsfornew2020-modeliPhonemodels.RelativetopreviousiPhonemodelcycles,however,about40%lessfoundryproductioncapacitywillbeavailableforthe2020models.InlightofbottleneckssuchasEUVlithographyyieldsinavolume-productionsetting,weexpectonlycertain2020iPhonemodelswillbeequippedwith5nmAPs.AppleconsequentlystillneedstoreserveTSMC’s7nmProproductioncapacity.TSMCisthereforelookingintoexpandingits7nmproductioncapacity(+30kwpm)fornewcustomers.Weaccordinglyexpectfoundrycapexplanstobesolidagainin2H2019,inlinewithSPEmakers’initialexpectations.Back-endSPEinvestmentwilllikelyincreaseintheshortterminconnectionwiththeHuaweisanctions.Otherwise,weseenosignsofrecoveryinspendingonsemiconductorprice-sensitiveassemblyequipment.OnemidtierOSATsupplierhasstartedtoinvestinflipchipcapacity,albeitonasmallscale,afterapparentlychangingitsstrategyunderanewmanagementteam.Technologyinvestmentseemstobelimitedtoahandfulofchipdevelopmentprojectsthatarenotleadingtoinvestmentinvolumeproductioncapacity.

Logic,foundry,andCIStrendsOurviewbasedonoursurveySamsunglikelytoOursurveyturnedupnothingsufficienttoalterourviewhere,withcapacityutilizationatreceive7nmprocessTaiwanesefoundriesstillgenerallydepressed.SamsungElectronics’LSIproductionisordersfromQualcommmeanwhilenowlookingcomparativelyfirmamidimpendingordersfor7nmEUV-basedforsmartphoneproductionofQualcomm’sSnapdragon700/600series(TSMCishandling7nmproduction“volume-zone”oftheSnapdragon800forflagshipphones)andthefirstreboundincryptocurrency-relatedprocessorsdemandinayear.Fundamentalsareexceptionallyweak,delayingtheexpectedconclusionofsemiconductorinventoryadjustmentstoJulyorAugustfromJuneevenindependentoftheHuaweisanctions.DemandfromHuawei(HiSilicon)isbeingrevisedbothupanddownamidcontinuedfluidityinthesituation,butHuaweiismakingapositivecontributiontofoundrycapacityutilizationoverall.Huaweiinitiatedaspecialprocurementprojectoverayearagopremisedontheverysanctionsscenariowearenowseeing,andanyliftingofthesanctionsgoingforwardthereforeposesriskofinventoryadjustmentsfortheoverallsupplychain.TaiwanesefoundryCapacityutilizationatTaiwanesefoundrieswas79%in2Qandisexpectedtorecoveronlyutilizationshouldto83%in3Q,withfullcapacitylookingquiteawaysoffinanegativeforsemiconductorrecovergraduallybutmaterialsandbackendSPE.Withinthis,however,2Qutilizationrecoveredto100%forthelikelytobefarfromfull-advanced7nmand12/16nmprocessesusedmainlyinflagshipandotherhigh-endcapacityin3Qsmartphones.Weexpectutilizationtoremaindepressedfor28nmandolderprocessesforbothautomotiveandindustrialapplicationsamidUS–Chinatradefriction.SamsungElectronicsconverselylookscomparativelyfirminits300mmcapacityutilizationforLSI,whichisrunningataround90%.ThisreflectsfirmdemandforuseinSamsungsmartphonesandalsoCISaswellasarecoveryincryptocurrency-relateddemandfromlateMay.Thecompanyplanstoramp7nmEUV-basedproductionofQualcomm’sSnapdragon7250in4Q.WhileTSMCismakingthe7nmflagshipSnapdragon865,SamsunghassecureddemandforQualcomm’svolume-zoneprocessors.CISresolutionsInCIS,thetrendstowardmulti-cameraphonesandhighercameraresolutionscontinue.continuetoimprove;Midrangesmartphoneswillstartusing48MPsensorsfrom2H,andflagshipphonesareonshifttomasscoursefor64MP.Planscallfor108MPsensorsfrom2020,allofwhichhasCISinproductionof64MPcontinuedtightsupply.TheHuaweisanctionsareaffectingproductionofhigh-endphonesdevicesin2H,thenfortheEuropeanmarket,butthislookslikelytomerelyeaseratherthaneliminatethe108MPin2020supplyshortage.SemiconductorcapacityutilizationMarketfeedback■CapacityutilizationatTaiwanesefoundrieswasjust79%in2Qandisexpectedtorecoveronlyto83%in3Q.■Byprocess,7nmand12nm/16nmlinesarerunningatfullcapacity,and28nmutilizationhasimprovedtonearly80%from60–70%sincelateMayamidadditionaldemandfromHiSiliconandothers.■12nm/16nmlinesreachedfullcapacityinMarchamidbackupoutputinresponsetoissueswithresistquality.Thisinitiallylookedlikeatemporaryrebound,butdemandsurgedagaininMay.Utilizationhereisnowabove100%andthehighestforany300mmprocess.■Taiwanfoundries’200mmlineshaverecoveredto83%utilization(1Q76%),buttheoutlookisuncertain.

■TSMC’sNanjingfabreboundedtofullproduction(15kwpm)frommid-MayamiddemandfromHiSilicon,butitwasbackdowntoaround80%asofJune.■SamsungElectronics’LSIlinesaretrendingataround90%utilization,includingarecentreboundforthe14nmprocess.■Cryptocurrency-relateddemandisrecovering(~10kwpm).SamsungElectronicshasreceiveditsfirst-everordersfor8nmchipsforBitmain’sAntminer(TSMChadbeensupplying16nmchipsbeforedemandplungedinmid-2018).■ResolutionoftheIntelCPUshortageintheChinesemarketwasdelayedtoApril2019.AMDlookstohavecoveredtheshortfall,butsupplynonethelessremained5–10%shortofdemand.■DemandforindustrialsemiconductorswasreviseddowninAprilandMayduetoUS-Chinatradefriction.DemandhassoftenedfurthernotonlyinChinabutalsoinEurope,andrecoverytimingremainsunclear.■DealersinChinaandTaiwanareavoidingholdinginventoryduetopoorvisibilityondemandatend-customers.■Somerespondentsbelievedemandcouldsurge(includingdoubleordering)ifUS–Chinatradefrictioneases.Also,whiletherecontinuestobenosignwhatsoeverofarecovery,somefoundrymakersarerecommendingthatcustomersquicklysecureinventorypremisedonsuppliestighteningrapidlyshoulddemandreboundin2H.■SemiconductorinventoryadjustmentsarenowexpectedtoconcludeinJulyorAugustinsteadofJuneaspreviously.Taiwanesefoundries:300mmlinesrecoveredin2Q,butfullcapacityunlikelyin2HCapacityutilizationatTaiwanesefoundrieshasbeendecliningfroma2016peakandlookssettofallfurtherin2019.Thisreflectsapersistentstructuralissueintheformofaglobalglutinfoundrycapacity.Utilizationon300mmlinesnowlookssettorecoverto79%(previously74%)in2Qfrom71%in1Q.ArecoveryindemandfromHiSilicon,Qualcomm,AMD,othernon-iPhoneAPapplicationsisdrivingup7nmutilizationwhile12nm/16nmlinesarenowatfullcapacityversus1Q’salready-strong90–95%.DemandfromMediatekandHiSiliconappearsbiasedtotheupside.Thisiscomingdespitealackofanyupwardrevisioninoverallhardwareproductionvolumeandappearstoreflectspeculativedemandand/orsupply-chain(supplier)changesinconnectionwiththeHuaweisanctions.Capacityutilizationlookssettorecoveronlytoaround83%in3Qandout,downfrom100%atthe2016peak,96%in2017,and90%2018.Wethinkthisaccountsforthemarket’sexpectationthatsemiconductorinventoryadjustmentswillpersistforanothermonthortwobeyondtheiroriginallyanticipatedconclusioninJune.Roughly20%YoYUtilizationon150/200mmlinesislikewisejust85%amidweakdemandforindustrialandadjustmentinChineseautomotiveapplications.AutomotivedemandinChinaisdownaround20%YoYforbothautomotivechipsemiconductorsandcomponentsdespitetaxbreaksfornew-carpurchases,andweseedemand;recoverystillnosignsofrecovery.LocalChinesedealersarealsoshowingzerointerestinsomewayoffaccumulatinginventoryduetopoorvisibility.Thishassomeofourrespondentsanticipatingdoubleortripleorderingifsomethingtriggersademandreboundandvisibilityimproves.

Figure9:ProjectedcapacityutilizationforTaiwanesefoundry300mm/200mmlines(inputbasis)0011223344556677889911111111111111111111QQQQQQQQQQQQQQQQQQQQ13131313131313131313120%120%)FOREmCASTsm110%110%te0a0R/2n0100%100%o03ti(azte90%90%litiarUnolyti80%80%raterzliati70%70%uUQlyCthn60%60%MSoTM50%50%.n.y...y...y...y...y...y...y...y...y...y.aapenaapenaapenaapenaapenaapenaapenaapenaapenaapeJMSJMSJMSJMSJMSJMSJMSJMSJMSJMS2010201120122013201420152016201720182019300mm(Input)200mm(Input)TSMCtotalutilization(sales)Source:CreditSuisseestimatesFigure11:ProjectedquarterlyutilizationratesforFigure10:ProjectedquarterlyutilizationratesformajorTaiwanesefoundry300mmlines,byprocessmajorTaiwanesefoundry300mmlines(inputbasis)(inputbasis)110%110%99%99%100%95%100%93%90%90%89%87%90%84%80%87%80%82%7892%%70%70%76%75%71%60%60%50%50%40%40%1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q2013201420152016201720182019201320142015201620172018201990/65/55nm40nm28nm300mmFab20/16/12nm10/7nmSource:CreditSuisseestimatesSource:CreditSuisseestimates

7nm/5nmproductionanddevelopmentatTaiwanfoundries/KoreanLSImakersMarketfeedback■Demandforthe7nmprocessisbooming,withTSMCrenewingplansforcapacityexpansion(+30kwpm)afterrevisingdownthreemonthsago.■The5nmprocesslookssetforriskproductionin2Qandarampfrom4Qasscheduled(TSMCofficiallytargetsriskproductionin2Q2019andvolumeproductionin2Q2020).Capacityfor5nmisscheduledtobeexpandedtoaround30kwpmbyend-2019and50kwpmby2H2020.■Commercializationofsingle-chip5GSoC(5Gmodem+AP)isbeingbroughtforward.SamsungElectronicsplanstobeginsupplyingits8nmExynoschipin2H2019,MediatekwillbesupplyingOppo,Qualcommplanstoreleasewithinthisyear.■QualcommisusingTSMC’s7nmprocessforitsSnapdragon865forflagshipsmartphonesandSamsungElectronics’7nmEUV-basedprocessforitsSnapdragon7250/6250forhigh-endandmidrangephones.TSMCplans30kwpmof5nmcapacity;impliesonlypartialusein2020-modeliPhonesNew2020iPhoneTSMCisinthefinalstagesofnegotiationswithSPEmakerstowardexpandingits5nmmodelslikelytofeatureproductionlines.Thecompanyplanstoincreasecapacityto30kwpmbyend-2019andboth5nmand7nmhasalsobeenprocuringoneEUVsystempermonthsinceApril,whichwethinkshouldchipshaveitreadytomakeAPsfor2020-modeliPhones.However,TSMChastypicallysecuredaround50kwpmofcapacityfornew-modeliPhones(aswellasthefirst-everuseofEUV)leadustoconcludethat—evenifiPhoneproductionvolumedeclines—the5nmprocessisunlikelytobeusedacrosstheentirenew-modelrange.Assumingthatitisindeedusedacrossallnewmodels,wethinkthiscouldimplytotaliPhoneproductionofnomorethan50–60mnunitsin2020inapotentialnegativeforthetechnologysectoroverall.SamsungElectronicslookssettorampits7nmEUVprocessbeginningwiththeExynoschipfortheGalaxyS11launchinginspring2020.SamsunghasalsosecuredordersforQualcomm’sSnapdragon7250foruseinhigh-endphonesandlookstorampproductionherefrom4Q2019.

Figure12:SmartphoneapplicationprocessormakertechnologyroadmapSource:CreditSuissee2s0t1im4ates2015201620172018201920201Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4QAppleA8A9A10A10XA11A12A13A14(20nm)(16nm)(16nm)(10nm)(10nm)(7nm)(7nmPro)(5nm/7nmPro)MSM8994ChinMSMa8996semicoMSnM89d98uctorsSDMa845ndrelSMa81t50edSmDX50ateriSDaM8l65sSDM875(20nm)(14nm)(10nm)(10nm)(7nm)(10nm)(7nmPro)(5nm)MarketfeedbackSDM710SDM712SM7150SM7250Qualcomm(10nm)(10nm)(8nm)(7nmEUV)■Chipmakersarelookingtotakeadvantageofcurrentlydepressedmarketconditionstosecurelong-termmaterialcontractsfor2020andbeyondatfavorableterms.SDM660/630SDM670SM6150SM6250(14nm)(10nm)(11nm)(7nmEUV)ContinuedriskoflowerpricesamidslowrecoveryindemandExynos5422Exynos7420Exynos8890Exynos8895Exynos9810Exynos9820Exynos(7nmSamsung(28nm)(14nm)Aswith(1o4numr)lastsurvey(1th0nrme)emonthsa(1g0nom,)weseenom(8nomv)esbymajorEUwV)afermakerstocutlong-termcontractpricesforsiliconwafers,buttheycontinuetobeaffectedbyMediatekX10/MT6795adjustmenX2t0s/MtTo679w7afervolumXe30sduringcontrPa60ctperiodP7s0.P805GSoC(28nm)(20nm)(10nm)(12nm)(12nm)(12nm)(7nm+?)Semiconductormaterialmanufacturersassumearecoveryindemandfrom2H2019,butHiSiliconKirinKirin930Kirin950Kirin960Kirin970Kirin980Kirin985(7nmPro)/920(28nm)weseedo(1w6nnm)side(1r6insmktothatout(l1o0nomk),asitlooks(7nmin)creasingly990l(i7knme+l)ythattherundowninsurplusmemoryinventorywillslipinto2020.Also,amidsoftdemand,pricedeclinesremainarisk,assomewafercustomersarelikelytopushforlowerpriceswhenlong-termcontractscomeupforrenewalin2019.CISmarket/productiontrendsMarketfeedback■Multi-camerasmartphonesareexpectedtocompriseover60%ofallmodelsin2019andover70%in2020.Triple-cameramodelsareexpectedtoaccountfor20%ofthetotalin2019andanevenhigherportionin2020.■64MPsensorsappearsetforuseinSamsung’sGalaxyAseriesandintriple-cameraChinesesmartphonesfrom2H.Mostofthesearedesigned-inbySamsungElectronics.■Useof48MPsensorsisexpectedtoexpandtomidrangephones($200–$300)in2020.■40MPsensorsareexpectedtobeusedinfront-facingcamerasfrom2020.■108MPsensorsareexpectedtobeadoptedfrom2020.■BothSony’sandSamsungElectronics’300mmCISlinesareexpectedtoremainatfullcapacitythroughtheendof2019.

■TheHuaweisanctionshaveledSamsungtohaltshipmentsofLSIforCISmodulesproducedatitsplantinAustin,Texas.■CapacityexpansionplansforSamsung’sS4line(formallyLine11)havebeentrimmedto+5kwpmfor2019andto+10kwpmfor2020.Thisreflectslimitationsonequipmentsupply.Migrationtohigher-resolution(64MP,108MP)camerascontinuesThetrendtowardtriple-camerasmartphonescontinuestoaccelerate.Weprojectthatmulti-cammodels’shareofsmartphoneshipmentswillincreasefrom40%actualin2018to60%in2019and70%in2020(bothforecastsunchangedfrombefore).Ofmulti-cammodels,thosewiththreeormorecamerasaccountedfor2%ofsmartphoneshipmentsin2018.Weexpecttheirshareoftotalshipmentstoincreaseto20%in2019and27%in2020,revisedupwardfrom15%and22%respectively.AlthoughtheCIS(CMOSimagesensor)marketfacesmultipleheadwinds,includingdownwardrevisionofHuawei’ssmartphonesalesoutlookduetotheaforementionedsanctionsanddownsiderisktoiPhoneunitsalesintheUSduetoincreasedimporttariffsinconnectionwiththeUS-Chinatradeconflict,CISmakerssuchasSonyandSamsungElectronicscontinuetooperatetheir300mmproductionlinesatfullcapacity.IncreasinguptakeofOnefactorbehindthesemakers’highcapacityutilizationisongoingmigrationtohigher-48MPdevices;likelyresolutioncameras,atrendthatreducesCISoutputperwafer.Newsmartphonesadoptionof64MPin2Hincreasinglycomeequippedwith48MPcamerasandsmartphonemakersplantoupgrade2019,then108MPinsomemodels’cameraspecsto64MPin2H2019and108MPin2020.2020SonyplanstoincreaseCISproductioncapacityonits300mmlinesfrom100kwpmto130kwpmbyFY3/21byaddingmoreproductioncapacitywithinanexistingfabandimprovingproductivity.Itisalsotentativelyplanningtobuildanewfab,presumablyatitsNagasakiPlant,tomeetdemandgrowthfromFY3/22onward.Samsunglikewiseplanstoexpandits300mmproductioncapacityto70kwpmin2019(apreviouslyplannedcapacityexpansionto75kwpmhasapparentlybeendelayedbyequipmentthroughputconstraints)andto85kwpmin2020.ThelatterexpansionwillbeachievedbyconvertingaformerDRAMline(Line11)toCISproduction.Even200mmlineshavebeenoperatingatfullcapacityasrecentlyaslastquarter,buttheircapacityutilizationisapparentlynowdecreasinginresponsetoreduceddemandforlow-resolutionCISs(suchas5MP).Figure13:Multi-camerasmartphonequarterlysalesweightingsFigure14:Multi-camerasmartphoneweightings70%80%%ofMultiCamera60%70%%ofmultitotal50%%oftripleormore60%%ofTriple/Quad/QuintCamera40%50%40%30%30%20%20%10%10%0%12341234123412341QQQQQQQQQQQQQQQQQ0%5555666677778888911111111111111111000000000000000002222222222222222222220101010122567801092E0Source:IDC,CreditSuisseSource:IDC,CreditSuisseestimatesE

Figure15:SmartphoneshipmentsbycameraFigure16:Smartphoneshipmentsbycameraresolution(units)resolution(%)<8MP<8MP500100%500100%8MP<12MP8MP<12MP12MP<16MP12MP<16MP45045016MP<20MP80%16MP<20MP80%40040020MP<20MP2TB2TB-2.9TB>3TB999GB1TB-1.9TB>2TB2TB-2.9TB>3TBSource:TSR,CreditSuisseSource:TSR,CreditSuisseFigure37:EnterpriseSSDshipmentsbymakerFigure38:EnterpriseSSDsharebymakerEnterpriseshipmentbysupplierEnterpriseshipmentbysupplier3,000100%90%2,500)80%sc2,000)ps70%ck(1,500pk60%sit(50%n1,000sit40%Un500U30%20%0rrltrrtrrtrrtrr10%nabeapyanuugupecvocenabeapyaenlygupecvocenabeapyaenlygupecvocenabeapyaenlygupecvocenabeapJFMAMJJASONDJFMAMuuJASONDJFMAMuuJASONDJFMAMuuJASONDJFMA0%rryltvcrrytvcrrytvcrrytvcrrJJJnabeapanuugupecoenabeapaenlygupecoenabeapaenlygupecoenabeapaenlygupecoenabeap20152016201720182019JFMAMJJASONDJFMAMuuJASONDJFMAMuuJASONDJFMAMuuJASONDJFMAJJJ20152016201720182019SamsungIntelSandisk(Fusion-io)WDC(STEC)WDC(HGST/Sandisk)Toshiba(OCZ)OthersSamsungIntelSandisk(Fusion-io)WDC(HGST/Sandisk)WDC(STEC)Toshiba(OCZ)OthersSource:TSR,CreditSuisseSource:TSR,CreditSuisse

Figure39:PCSSDshipmentsbydensityFigure40:PCSSDshipmentmixbydensityPCbydensityPCbydensity14,000100%90%12,00080%10,00070%)s8,00060%cp6,000p50%k(css(k)40%it4,000n30%U2,000U20%n0its10%nbrarpynlugptcvcnbrarpyelygptcvcnbrarpyelygptcvcnbrarpyelygptcvcnbrarpaJeAauJJueOoeaJeAanuueOoeaJeAanuueOoeaJeAanuueOoeaJeA0%lFMMASNDFMMuJJASNDFMMuJJASNDFMMuJJASNDFMnpanyrugptvcnbrpaeygnbyrleygpvcnbegvtncrpaaJuaJuecoeeanauuOoaJeaapAunueOoeeaAnuuocaeeb20152016201720182019FeMAMJASONDFJMAJMJuASecNDeFMJMAJuScNDFJMapMJJuASeNODJFMAblyptctraylyp20152016201720182019<32GB33-64GB64GB65-128GB129-256GB256GB512GB>1TB<32GB33-64GB64GB65-128GB129-256GB256GB512GB>1TBSource:TSR,CreditSuisseSource:TSR,CreditSuisseFigure41:PCSSDshipmentsbymakerFigure42:PCSSDsharebymakerPCshipmentbysupplierPCshipmentbysupplier16,000100%14,00090%80%12,000)s70%10,000cp60%pcs(k8,000k(50%)s6,000itn40%UU30%n4,000its20%2,00010%00%nbrarpyanlugptcvocenbrarpyaelygptcvocenbrarpyaelygptcvocenbrarpyaelygptcvocenbrarpJaFMAMJJuASONDJFMAMJASONDJFMAMJASONDJFMAMJASONDJFMAaJeFMAMuJJuAeSONDaJeFMAMnuuJuAeSONDaJeFMAMnuuJuAeSONDaJeFMAMnuuJuAeSONDaJeFMAnebapraunluectoeanebapraJuulyuectoeanebapraJuulyuectoeanebapraJuulyuectoeanebaprJJJrygpvcryngpvcryngpvcryngpvcr2015201e6201e7201e8201920152016201720182019SanDiskWDC(HGST/Sandisk)IntelToshibaSamsungMicronLite-OnITOthersSanDiskWDC(HGST/Sandisk)IntelToshibaSamsungMicronLite-OnITOthersSource:TSR,CreditSuisseSource:TSR,CreditSuisseNANDsupplyoutlookMarketfeedback■NANDmakersarerestrictinginvestmentsforoffsettingcapacitylostinthetransitionto3DNAND,effectivelyreducingtheirproductioncapacity.■USdatacentersarerefurbishingend-of-life(EOL)eSSDforreuse,anditseemsthatasupplychainforresaleintheChinesemarketisupandrunning.Reductioninsupplycapacityongoing,evidenceofrefurbishedproductmarketemergenceInventorysurplusesIntandemwithinvestmentinthemigrationto64/7X-layerand9X-layerNAND,makershadnowpeakingoutatlast,beenmakinginvestmentstocompensatefortheresultantproductioncapacityloss(fallinduetonaturalattritionoutputcapacityofexistingfacilitiesduetoanincreaseinthenumberofprocesssteps).andintentionaloutputWeunderstandthatnow,however,theyarerefrainingfromsuchcapex,effectivelylettingcutstheirproductioncapacitydeclinebyaround5−10%.SKHynix,whoseprofitabilityismostunderthreat,isallowingthisnaturalreductionincapacitytoshapeitsoperations,ratherthanimplementingdeliberateproductioncuts(Micron’s5%outputreductionhasasimilarorigin).ToshibaMemory(TMC)hasscaledbackits2DNANDoutputbyseveraldozenpercent(waferinputvolumereductionbase)sincethestartoftheyear,andimplemented3DNANDproductioncutsfromMarch(cutsof30%inMarch,10−30%fromAprilonward).

Theimpactofthesecutsshouldfilterthroughfrom2Q,deliveringareductioninthecompany’sexcessinventory(equivalenttothreemonths’capacity).End-of-lifeSSDsatdataMeanwhile,USdatacentershaveemergedasanewsourceofSSD.TheyarecentersrefurbishedrefurbishingEOLeSSDthatisnolongerfitforpurposefortheirownuseandappeartoandsoldtotheChinesehaveestablishedasupplychainforitsresaleintheChinesemarket.ThesamethingmarketseemstobehappeningforHDDs.Thesizeofthismarket,andconsequentlyitssupplyimpact,iscurrentlyhardtogauge.WehadassumedthatdatacenterswoulddowngradeEOLproductsforcolddatastorageuse.ThatthesearenowasourceofSSDsupplyforthelow-endmarketcouldposearisktosuppliers.Justastightsupply–demandfrom2017stimulatedtheretailmarkettousedowngradedproducts,thisconfirmsthatNANDusersarewillingtolookbeyondregularhigh-qualityproducts.NANDinventoryoutlookMarketfeedback■NANDinventoryadjustmentbycustomerdatacentersismore-or-lessover.■Thebest-casescenarioisthatNANDmakerswillreducetheirexcessinventoryfromthe12weeks’productioncapacitytheyheldin1Q2019to3−4weeks’worthbytheendoftheyear.Somemakerscontinuetoprioritizemarketshareoverproductioncuts,whileothershavestartedtoplaceprofitabilityaboveshare.■Allmakersseeexcessinventorypeakingin2Q.Customerinventoryadjustmentcomplete,inventorywillremainexcessiveatNANDmakersthrough2020InventoryreductionremainsslowerthanNANDmakerstargeted.Thisisduetodepresseddemandforhigh-memorycapacitysmartphonesandtheplateauingofmidrangephonestoragecapacityat128GB.Havingstoodattheequivalentof12weeks’productioncapacity,NANDmakersuniformlyexpectexcessinventorytopeakoutin2Q.However,hardlyasingleoneseemstobelievetheycanreduceinventorytoanappropriatelevelbyend-2019,andtheyareresignedtoentering2020withexcessinventorystillontheirhands.Whilethepictureismixed,2−3weeks’inventoryseemstobethekindofleveltheyenvisage.NANDpricingoutlookMarketfeedback■USmakershaveintensifiedpricecuttingsince2018.WeunderstandIntelisstillaggressivelycuttingprices,whileWesternDigitalhaseasedupsomewhat.■NANDwaferpricesseemtohavebottomedat$0.05–0.06/GB($1.6–1.9for256GB).Prices(midpoint)areroughly25%downfromMarch,implyinganOPMworsethan−50%.■USNANDmakers,directlyimpactedbyrestrictionsonsupplyingHuawei,appeartobecuttingpricesagainforcSSDandeSSD.PricesofcSSDare$22–23for256GB($30in1Q)and$45–46for512GB($50)andcontinuetofall.■NANDmakersassumeNANDpriceswillbottomin2H2019,butthedowntrendcouldpersist,dependingonthesituationatUSmakersthathadsuppliedHuawei.■NANDpricesareunlikelytoturnupwardforallapplicationsuntilatleast2Q2020.PricesforsmartphoneNANDlooktheleastlikelytopickup.■WeunderstandNANDmakersseektoraiseprices,butcustomershaverejectedalltheirproposalsregardingNANDwaferandcSSD.Conditionsdonotseemripeforpriceincreases,giventhatcertainmakersseemtoputastrategicpriorityonmarketsharein

smartphoneNANDapplications.TheindustryappearsconcernedabouttheriskofUSNANDmakersadjustingpricestrategiesduetotheHuaweisanctions.■NANDmakerscontinuetopushforpriceincreases,withplanstoraisepricesforNANDwafersin3Q,cSSDandeSSDin4Q,andeMMCandeUFSin2Q2020.DemandunlikelytosupportpriceincreasesMakers"attemptstoNANDmakersarepostingoperatinglossesandthereforeseektoraisepricesbuthavehikepriceshavemetfacedacross-the-boardrefusalsfromcustomers.Giventheincreasinglyserioussupplyacross-the-boardglut,NANDmakercomplaintsaboutlowmarginsareunlikelytopersuadecustomerstorefusalsbycustomersacceptpriceincreases.Also,NANDmakersarenotallpushinguniformlyforpriceincreases;somecontinuetoprioritizemarketshareinstead.AmongUSmakersthathadaggressivelycutpricessince2018,weunderstandIntelcontinuestolowerSSDpricesinChina,butWesternDigitalhasreinedinpricecutting.JapaneseandSouthKoreanmakersseemwaryoftheriskthatUSmakerswillintensifypricereductionsduetotheHuaweisanctions.NANDwaferpricesGivensluggishOEMdemand,NANDmakersseektoreducewaferinventorybysellingdownto$0.05/GB,thiswaferstomodulemakersandothercustomers;during2Q,pricesfell25%QoQ.WeisgivingOPMsworseunderstandcompetitionhasbroughtNANDwaferpricesdownto$0.05–0.06/GB,givingthan-50%OPMsworsethan−50%.PricesforPC-usecSSD,wherepricesensitivityishigh,entereda“sweetspot”in1Q($30per256GB)amidacceleratinguptakebyPCmakers,butturneddownwardagainin2Q,reachingtheunusuallylowlevelof$22–23.Nowthatpricesfor512GBNANDhavefallento$45–46,weexpectSSDadoptiontopickupsteam(weestimateuptakeof70%for2019).NANDmakersfacethisharshpricingenvironmentbutshouldseeanincreaseiniPhone-relateddemand(theonlysourceofdemandlikelytopickupin2H)andareapparentlyfightingtoseizemarketshare.Pricingcompetitionseemsinevitable,assomemakersseektosecurevolumeeveniftheyhavetoacceptunfavorablecontracttermsfromApple.Inthisenvironment,NANDmakersseemgenuinelycommittedtoraisingprices.ThemajorsplanpriceincreasesforNANDwafersin3Q,andcSSDandeSSDin4Q.Managementindicatespriceincreaseswillbedifficultuntil2Q2020,givenfiercecompetitioninsmartphoneNAND.

Figure43:128GbTLCNANDcontractpriceUS$10.009.008.007.006.005.004.003.002.001.000.00JASONDJaFMApMJJASONDJaFMApMJJASONDJaFMApMJJASONDJaFMApMJJASONDJaFMApMulyugepctovecnebarauulyugepctovecnebarauulyugepctovecnebarauulyugepctovecnebarauulyugepctovecnebararynrynrynrynry201420e1520e1620e1720e182019Source:DRAMeXchange,CreditSuisseFigure44:256GBTLCSSDpriceNANDcontractpriceTLCSSD256GB90807060D50SU40302010077778888991-1-r1l-1t-1-1-r1l-1t-1-1-rnapucnapucnapJAJOJAJOJANANDcontractpriceTLCSSD256GBSource:DRAMeXchange,CreditSuisse

Figure45:NANDmakersOPM80.0%60.0%40.0%20.0%0.0%-20.0%-40.0%-60.0%-80.0%1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2010201120122013201420152016201720182019ToshibaSamsungSKHynixMicronIntelSource:DRAMeXchange,Companydata,CreditSuisse3DNANDmassproductionanddevelopmentMarketfeedback■Samsungplanstoraise92-layer3DNANDoutputto140–150K/monthin2019(50–70Kin2Q).ToshibaMemorytargets140Kof96-layer3DNANDcapacityatend-2019butactualoutput(waferinputbasis)willhingeondemand.■Samsunglookssettobringonline10Kof128-layer3DNANDcapacityatend-2019andplanstoshipcommercialsamplesforsmartphonesin2Q2020.BesidesretailSSD,thefirstapplicationforthisislikelytobetheGalaxyS12slatedforlaunchinspring2021.■ToshibaMemoryaimstosupplyengineeringsamplesofits112-layer3DNANDchipBiCS5atend-2019followedbycommercialsamplesinearly1Q2020.TheplanistofocusoncardmemoryandcSSDsinitiallytoironoutthebugs,andthensupplycommercialsamplesforthesmartphonemarket.WeunderstandeSSDsamplesusingthe96-layerBiCS4willbeavailablebyend-2019.■Accordingtosomesources,YMTC’s64-layerchipsarefarfromready.■WeseetwopossibilitiesforthenewiPhonemodels:only9X-layer3DNANDisused,orboth9X-layerand64-layer3DNANDareused.Planstomassproduce92&96-layerchipsfrom2H,supplying112&128-layercommercialsamplesfrom1H2020Outputof9X-layerNANDislikelytotakeofffrom2Q,withsubstantialOEMsupplycapacityinitiallyallocatedforiPhones.However,formakersotherthanSamsung,whichproduces92-layer3DNANDwithoneetchingprocess,marginsonthese96-layerchipsarelikelytobenarrowerthanfor64-layerones.Weseeongoing112&128-layerdevelopment.SamsungandToshibaMemoryapparentlyaimtoshipengineeringsamplesbyend-2019andstartmassproductionfrom2H2020.Aswith9X-layertechnology,Samsungistheonlymakerplanningtoproducethechipswithoneetchingprocess.WethinkToshibaMemorywillproducea112-layer3DNANDthatstacks64and48-layerdecksontopofeachother.

DespitenumerousreportsabouttheeffortsofChina’sYMTCtomassproduce64-layerchips,wehearditisrunningintoconsiderabledifficulties.Managementisnegotiatingdetailswithfront-endandback-endSPEmakers,butanyinvestmentdecisionwillhingeonproductyields.WhentalkingwithSPEmakers,wesensedtheyhavefewexpectationsforcapexin2019–2020.TheeffectsofsuchinvestmentdecisionswouldlikelyhamperNANDpricesrecoveryfrom2020.YMTC"s3DNANDrolloutcouldposeariskforNANDpricesfrom2020.Figure47:2D/3DNANDproductioncapacityFigure46:2D/3DNANDsupplybitforecastsforecasts1,80090%90.01,60080%80.0wp1,40070%70.0(Km)1,20060%ca60.0pG1,00050%actoB50.0itayo)(m56.880040%fl58.1%n40.051.052.556.440.445.960030%30.134.630.015.322.0pro40020%N5.57.68.3AP2.33.7duN3ro20.0cM20010%Ddtiaouc22.422.824.223.423.521.520.819.920.7sn3sti10.018.217.115.614.312.512.616.0CD00%oanpa0.0cit1Q16E3Q16E1Q17E3Q17E1Q18E3Q18E1Q19E3Q19Ey1234123412341234QQQQQQQQQQQQQQQQ113DC1apaci1ty112D1Capa1city11%1ofto1talNA1ND1capac1ity12DNAND3DNAND6666777788889999EEEEEEEEEEEEEEEESource:CreditSuisseestimatesSource:CreditSuisseestimatesFigure48:NANDmakers"3DNANDtechnologyroadmapMassProductionSamsungToshibaMicronSKHynixYMTCCommercialSample201520162017201820192020Source:CreditSuisseestim1aQtes2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q3DNAND32Layers48Layers64/72Layers92/96Layers?112/128Layers

Front-endSPEmarketOurviewbasedonchannelchecksOursurveyconfirmsthatmemorymakershavebeenpostponingorcancelingCY19investmentplansinresponsetoaworseningoutlookfor2Hdemandandareevenlesskeenoninvestmentnextyear.MemorymakersForDRAM,theexistinginventoryglutlookssettopersistintoCY20andcloudtheoutlookfreezingorcancellingforsupply-demand.PricesarefallingespeciallysharplyforserverDRAMamidatardyinvestmentinprocessrecoveryinUSandChinesedatacenterdemand,whichcouldhaveserverDRAMfallingmigrationandmulti-tobreakevenorlossbyend-3Q.ThishasDRAMmakersnowstartingtoconsiderashiftinlayertechnology;littlestrategytowardsecuringprofitsratherthanreducinginventory.NANDpriceshaveappetiteforinvestmentmeanwhilebecomecomparativelysettled,butafull-scalereboundlooksunlikelybeforein20202QCY20andinvestmentisthereforesettoremaincentered—eveninCY20—onconvertingexistinglinesto9xratherthanonaddinganynewcapacity.BothDRAMandNANDmakerstypicallyinvestincompensatingagainstanylossofoutputcapacityaccompanyingprocessmigration,buttheongoingsupplygluthasthempostponingorcancelingsuchplansinwhateffectivelyamountstoaproductioncut.TSMCmullingLogicfoundryinvestmentlooksfirmcomparedwithmemoryasevidencedbyTSMCinvestmenttorampupsolicitingmassproductionsystemsforitsadvanced5nmprocessandalsoplanningto5nmand7nmprocessexpand7nmcapacity.Thisyear’snewmodeliPhoneswilluseboth5nmand7nmAPs,sooutputweexpecttheinvestmentcycleheretobemoremodestthanusualfornewiPhones.WethereforeseelittleupsidetofoundryinvestmentfromthelevelsSPEmakersareanticipatingandthinkthatunlessmorecustomersstartusingthe5nmprocessin2HCY20throughCY21,foundryinvestmentcouldactuallyseeareactivedeclineinCY20.Somearequestioningjusthowmanychipmakerscanaccommodatethehighcostof5nmandthereforehowstrongdemandfortheprocesswillbe.WeaccordinglythinksomecautionisinorderontheoutlookforcapitalinvestmentinCY20andout.WeestimatetheWFEBasedonalloftheabove,wereviseourforecastfortheWFEmarketto$37.5bnforCY19marketat$37.5bnin(−26%YoY;prev.$36bn)and$38bnforCY20(+1%YoY;$41bn).Wealsoseedownside2019(−26%YoY;prev.totheCY20outlookifmemorypricesfailtoimprovein2HCY19.Duetofoundry$36bn)and$38bnininvestmentin5nmand7nmcapacityexpansion,weassumepullbackinfoundrydemand2020(+1%YoY;$41bn)inCY20.Marketfeedback■SPEmakersarereceivinginquiriesfromTSMCregardinglineexpansiontoroughly30Kfor5nm-processmassproduction.InstallationisplannedfromAugust2019,followedbyaramp-upto50KfromJuly2020.■In5nmprocesses,theissueiswhetherchipcostwillbelowenoughtospurdemand;customersarelikelytodemandequipmentcostreductionsandproductivityimprovementsthatequalorsurpassthosefor7nmprocesses.■TSMCtargetsa30–35Kcapacityramp-upfor10nm,7nmand7+nmprocessescombined.Itisalsomullingincreasedoutputof16nmand12nmchips.■Samsunghasapparentlyapprovedaninitialinvestmentof$0.5–1.0bnintheXianPlant’sFab2(X2)facility.■SKHynixisconsideringinvestmentinretoolingitsDRAMFabfacilityinWuxifor1xnmprocesses,aswellasdeferralorcancellationofplanstoinvestin96-layerchipsatM15.■MicronplanstosupplyDRAM15nmchips(140S)fromBoiseintheUSdirectlytoTaiwan(previouslyviaHiroshima),whichwillincludeatechnologytransfer.Initialplanscallforsmall-lotproduction.

■AmongChinesememorymakers,CXMT(formerlyInnotron)signaledapossibleexpansionto40Kwafersbutislikelytomakeafinalinvestmentdecisionbasedonproductionyieldsatend-Juneorend-August.YMTCalsohasexpansionplans,butthesearenotfixedandhingeon64-layerchipdevelopment.■WestillseenoprogresswithHuawei’ssemiconductorproductionplans(itwasintalkswithSPEmakersasofSeptember2018).WFEmarketoutlookComparedwithourWFEmarketforecastinMarch,wemakeaslightupwardrevisiontoour2019outlook,astherisksweexpected(declinesatfoundries)havenotmaterializedduetofoundryinvestmentin5nmand7nmcapacityexpansion.However,wetrimour2020outlook,partlybecausearecoveryinmemory-makercapexplansseemsunlikelyandweassumepullbackinfoundrydemand.Wethereforeestimatethemarketat$37.5bninCY19(−26%YoY;previously$36bn)and$38bninCY20(+1%YoY;$41bn).ContrarytoourforecastTSMCwouldnotraiseitsofficialcapexplanfor2019($10-$11bn),thecompanynowlookslikelytomakeagreater-than-expectedadditionalinvestmentin7nmprocesses,whilekeeping5nminvestmentroughlyintheanticipatedrange.However,Applenowseemsmorelikelytouse5nmapplicationprocessorsforonlysomeofthenewiPhonemodelsin2020.TSMCusuallysecuresabout40–50K/monthofcapacityfornewiPhonemodels,butwethinkitonlyplanstoraise5nm-processcapacitytoamaxof30K/monthformassproductionin2020.TSMChadapparentlyintendedtoreallocatesurplus7nmprocesscapacity(duetoApple’sshiftto5nmchips)toothercustomers.However,nowthatthesomeofthe2020iPhonesarelikelytofeature7nmchips,weunderstandTSMCwillprobablylacksufficient7nmcapacitytosupplynon-Applecustomers.Forthisreason,thecompanyislikelytoinvestin30Kofnewcapacityfor5nmprocesses,plus30Kfor7nmprocesses.Wealsounderstanditplanscapacityexpansionfor12nmand16nmprocessfacilitiesastheyareoperatingatfulltilt.AmongChinesememorymakers,CXMTandYMTCarediscussingspecificplanswithcustomers;weunderstandCMXTislookingataround40KwafersandYMTC30–40K.CMXTintendstomakeitsinvestmentdecisionbasedonproductyieldsatend-Juneandend-August.YMTCislikelytoreachafinalinvestmentdecisionin4Q2019dependingonitsdevelopmentof64-layer3DNAND.ThepotentialforrecoveryinlocalChinesememorymakerinvestmentisbarelyincludedinourforecasts.Ifthetwomakersweretoinvest,wewouldlookforatotalofover$5bn(thiswouldnotbepositive,asitwouldlikelyleadtoalonger-termdeclineinmemoryprices).In2020,weseeanincreasedriskofDRAMprofitsswingingfrombreak-evenintotheredgiventheweakrecoveryindata-centerdemand.Inresponse,makersappeartoberefocusingtheirstrategyonmaintainingpricesbycontrollingsupply.Thismeanstheyareunlikelytofinishworkingthroughexcessinventorybyend-2019,whichbodespoorlyforDRAMsupply-demandin2020.WithpersistentlystrongdownwardpressureonNANDpricescenteringonsmartphonemakers,pricesareunlikelytoimproveforallapplicationsuntilatleast2Q2020(thoughtherecouldstillbeapartialpricerecoveryforsomeapplications).ThislikelyexplainswhynomakerappearstoplancapexincreasesforeitherDRAMorNANDin2020.FoundryinvestmentmaywellshrinkYoYin2020,giventhatexpansionin5nmprocesscapacitywilllikelybelimitedto50Kin2020,withpossiblefurtherincreasesofjust20K.

Figure49:WFEmarketforecast(Japanteamestimate)Bn$60.050.550.047.08.06.540.037.538.034.513.513.39.09.05.730.012.815.013.011.020.018.010.010.010.68.514.09.17.08.05.40.0456789012345678EE00000011111111190000000000000000122222222222222220022DRAMNANDFoundryLogic/OthersSource:CreditSuisseestimates

Figure50:Expecteddeliverytimingfornewmemoryinvestment:Eachcompanyactscarefullymovingtoward2020.Theyhaveincurredcapacitylossesasaresultofinvestinginprocessmigration(DRAM/NAND)andincreasedlayercount(NAND),buthavecompensatedforthisthroughcapex.Butincreasingly,suchcapexisbeingsuspendedorcanceledoutright.Source:CreditSu=isNseewecsatpimacaittyeesxpansion=Processmigration=Equipmenttransferorconversion2018201920201Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4QDRAMSamsung1xnmLine15Line16Line17Pyeongteak(P1)STOPPyeongteak(P2)Lowvisibilitytostartramp-upSKHynix1xnmM14(1stfloor)M14(2ndfloor)M17WuxiPostpone1.5quarterandfreezeMicron1ynmMMJ(Hiroshima)1xnmMMT(ex-Rexchip1xnmInotera1ynmNanyaFab3ANCXMTHefei,China(delayedonequarter)+40K?+60K?JHICC(Jinhua)Fujian,ChinaStopNANDSamsung64LPyeongteak(P1)2ndFloor(majorityisforDRAM)(3DNAND)92LPyeongteak(P1)48/96LXianFab1(X1)Transitionto64L92LXianFab2(X2)EquipmentmovesfromLine16(Capexonly700mn$approved)92LPyeongteak(P2)Toshiba64/96LY6Slow-down64/96LIwateWillinstallpilotlinefirstMicron64LFab10/10X,SingaporeSlow-down?StopNewFab,SingaporeSKHynix64/72LM14M15CancelledIntel32LFab68Phase2,Dalian64LFab68Phase3,DalianYangtzeRiver32LWuhan,China+40K?WinbondNORFlashKaohsiung

Figure51:Expecteddeliverytimingfornewlogic/foundryinvestment=Newcapacityexpansion=ProcessmigrationSource:CreditSu=isEsqeuipemsteimntatrtaenssferorconversion2018201920201Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4QFoundry/LogicTSMC10nmFab15P57nmFab15P67nm+Fab15P5/616nmNanjing,China5nmTainan(pilot)+25-30K+20KSamsung10nmFinFETLine177nmFinFETLine17CISLine11"+5Kby19/E+10Kby20/EIntel10nmFab28(Israel)STOPresume14nmFab42(Oregon)UMC40/28nmXiaMen,ChinaSMIC28nmB2,Beijing,China28nmB3,Beijing,China28nmShenzhen,ChinaNexchip90nmHefei,ChinaTacomaCISNanjing,China

Back-endSPEmarketoutlookOurviewbasedonoursurveyInthecontextoftheHuaweiproblem,thereisdemandforback-endSPEovertheshortterm.InadditiontodemandfromTaiwaneseOSATs,Chinesemid-tierOSATsnotinvolvedwithHiSilicon(aHuaweigroupcompany)haveapparentlybegunaroundofnewinvestmentswiththeintentionofstrengtheningtheirsupplychains.InthefirstweekofJune,however,productionofapplicationprocessors(AP)startedtoadjustforhigh-endmodelsforfoundryHiSilicon,sothereisprobablyariskofadjustmentsinback-endSPEdemand.Ouroverallimpressionisneutralwithvariousplusandminusfactorsinplay,suchascancellationsofsomecapexplansatUSmemorymakers.ExcludingtheimpactfromHuawei,webelievetheenvironmentforback-endSPEinvestmentremainsweakandlacksthemomentumforsemiconductorcapacityutilizationtosurpassitspreviouspeak.Insteadofageneralmalaise,itseemsthatweaknesscanbetracedtoindividualinvestmentplans.Inotherwords,overallSPEdemandhasnotstalledout,asindicatedbyongoinginvestmentsindevelopmentforlargerchipsizesinGPUandFPGA,aswellasflip-chipinvestmentsasapartofthebusinessstrategiesofOSATs.AtlocalChinesememorymakers(YMTC,CXMT),inquiriesarespecificallybeingmadeforback-endSPErelatedtotheirplanstoexpandproductioncapacity,butoncechipyieldsreachacertainlevel,finaldecisionsoninvestmentwillbemade,sothesituationisstillfluid.However,itseemstousthatdevelopmentisbehindschedule.Marketfeedback■Huawei-relatedback-endSPEdemandincreasedaftertheLunarNewYear.Inadditiontotheusualsupplychain,Chinesemid-tierOSATsalsoseemtobemakingnewinvestmentsforHiSilicon-relateddevices.■AsameansofdealingwithUS-Chinatradefriction,companiesarenotonlymovingtheirassemblyprocessesfromChinatoTaiwan,butarealsoinvestinginthebuildingoutofsemiconductorsupplychainsinsideChina.■MicroncancelledsomeNAND-relatedequipmentinresponsetotheHuaweiproblem,butcontinuestoinvestinDRAMmassproductionatplantsinTaiwanandChina.■Powertechbeganmemory-relatednegotiationsandFO-PLPdevelopmentforlogic.■SPEdemandshouldimprovein2HnowthatASEfinisheditsnewplantinKaohsiung.■OSATscontinuedevelopmentforlargerchipsizes,includingFPGAandGPU(packagesize52mmx90mm).InadditiontoXilinx,etc.,HiSiliconhasdevelopmentprojectsunderwaywithplanstostartmassproductionin1Q2020.■UndertheleadershipofnewmanagementteamsatOSEandWingtech,therearesignsofnewinvestmentsinflip-chippackages,etc.

Figure52:OSATs:AssemblycapacityutilizationforecastsTaiwanAssemblyprocessutilization100%90%80%70%60%50%40%123412341234123412341234123412341234123412341234123412341234123412341234QQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQQ2002200320042005200620072008200920102011201220132014201520162017E2018E2019EAssemblyUtilizationAsofDec2018estimatesSource:Companydata,CreditSuisseestimates

5GOurviewbasedonoursurveyInChina,Huaweihasnotchangedits5Gbasestationshipmenttargets.IfHuaweidoeschangeitstargets,therolloutof5GisunlikelytobeimpededthankstosupplyfromEricssonandNokia,aswellassoftwareupgradesextendingLTEcompatibilityinthe2.5GHzbandwidth.ChipmakersexpeditingAPmakersaremakingbetter-than-expectedprogressontheirinitialdevelopmentplansfordevelopmentofsingle-5Gmodemsandsingle-chipAPsolutions.Single-chipsampleshipmentsandmasschipsolutionsproductionarelikelytobeginin2019.DualchipsareacceptableinflagshipmodelsfromacombiningAPsandcostperspective,butmodemandAPcostsmustbereducedinhigh-endandmid-rangemodemsmodels,sothedevelopmentofsingle-chipsolutionsisanear-imperativeforthespreadof5Ghandsets.Dualchipscostmorethan$110,whereassingle-chipsolutionsshouldcostlessthan$60forhigh-endmodelsandaround$40formid-rangemodels.SamsungElectronicsLSI,Qualcomm,andMediatekplantoshipsamplesorlaunchmassproductionofsingle-chipsolutionsin4Q2019.Threemonthsago,weforecastshipmentsof50–70mn5Gsmartphonesin2020.However,wenowraiseourshipmentforecastsfor2020onwardinlightoffaster-than-expectedprogressonplanstostartmassproductionofsingle-chipsolutionsforAPandmodemsforhigh-endandmid-rangesmartphones,aswellasthereleaseof5G-compatibleiPhonemodelsin2020nowthatApplehassettleditsdisputewithQualcomm.Weestimatearound10mn5G-compatiblesmartphoneswillbeshippedin2019,expandingto120–150mnin2020and250mnin2021.Webelievelower-costsingle-chipsolutionscombiningtheAPwitha5Gmodemwillspurthespreadof5Gsmartphones.Marketfeedback■SomeAPmakersforecast5Gsmartphoneshipmentswillincreasefromabout10mnunitsin2019to120mnin2020and250mnin2021.The2020shipmentforecastisbrokendownas70mnunitsatChinesemakers,20mnunitsatApple,and30mnunitsatSamsungElectronics.■Partssuppliersforecastaround55mn5GsmartphoneswillbeproducedbyChinesemakers,with30mnatHuaweiand7–8mneachatOppo,Vivo,andXiaomi.■Chinesemobileoperatorshaveapparentlyaskedsmartphonemakerstopricetheir5G-enabledmodelsatlessthan3,000RMBin2020and2,000RMBin2021.For2021,somecompaniesthinktheshipmentratioof5Gsmartphoneswillbeatleast50%inChina.■Huaweiisreportedlytalkingwithdevicemakersaboutacceleratingthetransitionto5GsmartphonesduetosanctionsimposedbytheUSgovernment,adevelopmentthatwarrantsmonitoring.HuaweihasaskedJapanesesupplierstodeliver5G-compatibleRFfrontendmodules.■IntheUSmarket,saleshavebeensluggishfortheGalaxyS105GmodellaunchedbySamsungElectronics.IncontrasttoAsianmarkets,thespectrumallocationprocessisinefficientintheUSmarket,whichwilllikelyslowdownthetransitionto5Gsmartphones,accordingtosomecompanieswetalkedto.■Companiesareaheadofschedulecommercializingsingle-chip5GSoCs(5Gmodem+AP).SamsungElectronicsplanstomassproduceitsExynosonthe8nmprocessinlate2019.MediatekplanstosupplyOppo,whileQualcommplanstoreleaseitssolutionsthisyear.

■Qualcomm’sSnapdragon800seriesfor5GismadeonTSMC’s7nmprocess,butplanscallforproducingthe700series(Snapdragon7250)onSamsungElectronics’7nmprocesswithEUV.■Pricesforsingle-chip5GSoCswillbecheaperthanfordualchips,butwillstillcostmorethan$100,sotheywillfirstbefeaturedinhigh-endmodelsonly.After2020,planstargetachipcostof$60forhigh-endmodelsand$40formidrangemodels.Flagshipmodelshaveroomformorecostssotheywillusetwochips.■Huaweiisapparentlyonschedulewithits5Gbasestationproductionandshipmentplans.Figure53:Technicalroadmap–5Gmodemsandsingle-chipAP5GSoC201920201Q2Q3Q4Q1Q2Q3Q4QMPQualcommFlagshipSnapdragon8652chipswithX55(TSMC7nm)MPHigh-endSnapdragon7250(Samsung7nmEUV)MPMiddle-endSnapdragon6250MP(Samsung7nmEUV)MPAppleFlagshipA142chipswithX55(TSMC5nm/7nmPro)MPSamsungFlagship/High-end(Samsung7nmEUV)MPMPMiddle-end(Samsung8nm)(Samsung7nmEUV)2chipswithMPHiSiliconFlagship/High-enKirin990Balong5000(TSMC7nm+EUV)MPMiddle-endKirin730(TSMC??nm)MPMediatek5GSoC(HelioM70built-in)(TSMC7nm+EUV)Source:Companydata,CreditSuisseestimates

OtherareasOurviewbasedonoursurveyOurlatestsurveyrevealssignsthatdemandhaspickedupattheendofMayinrelationtocryptocurrency,securitycameras,smartmetersforgasutilitiesinChina,andNB-IoTforhomeappliances.However,thereisunlikelytobesufficientvolumeheretosupportabroaderrecoveryinthesemiconductormarket.Duetoaworseningfinancialsituation,Chineseautomakersareapparentlydelayingpayments,whichishavingaknock-oneffectthroughouttheirsupplychains.Governmenttaxbreakshavenotsparkedarecoveryinautomobilesales,andsemiconductordemandcontinuestodecreasearound20%YoY,leavingnoindicationsthatdemandwillrebound.LocalChinesesalesagenciesalsodonotanticipatearecoveryinmarketconditions,andtheyaretakingaverycautiousapproachininventorymanagement,showingreluctancetocomplywithsupplierdemandstobuildupinventories.SentimentseemstohavecooledoffsignificantlyacrosstheentiretechnologysectorinChina.Cryptocurrency■DemandforBitmain’sAntminerrosesharplyattheendofMay.ItseemsSamsungElectronicswonrelatedordersonits8nm/10nmprocess(succeedingTSMC’s16nmprocessfrombefore).Apparently,volumeisabout5–10k300mmwafers.Althoughthesourceofdemandisunknown,NvidiasawanuptickinspotdemandforGDDR.■Stillusingupfrontcashpaymentstopurchaseequipment■Cryptocurrency-relateddemandhasnotmaterializedinelectroniccomponentsyet.Automotive■Facedwithdeterioratingfinances,Chineseautomakershavelengthenedpaymenttermsmoresothansmartphonemakers,demandinglaterpaymentstoTier1andEMSfirms.Thisislikelytohaveknock-oneffectsonpaymenttermsthroughoutthesupplychain.■EVrechargingstationshavenotincreasedinoutlyingregions.■Expectationsarelowforpreferentialautomobilepolicies.ProductionlookslikelytoremainlowthroughSeptember.■BYDcutitsproductionsharplyfrom30,000to2,000vehiclespermonthinAprilandMay.However,theChinesegovernmenthasnotchangeditsoutlookfor1.5mnEVsales(vs.1.22mnin2018).Chinesesalesagencies■Chinesesalesagencyinventoriesarestillabovethetwo-monthmarkbutseemtobenormalizingatsomeagencies.■Suppliersarepressuringagenciestoholdmoreinventory,buttheyarenotkeentoexpandinventoriesamiduncertaindemand.■TIhasmadeprogressclosingdownsalesagenciesandchangingthestructureofagencyfunctions(convertingfromcapitalrecoveryandlogisticstodesignhousefunctions).

Other(IoT,homeappliances,securitycameras,etc.)■TherearesignsofstrongerdemandforIoTmodulesusedinsmartmeters(gasutilities)andNB-IoT-compliantmeters.■DemandisstrongforIoTmodulesatQuectel,SUNSEA,andFibocom.■IoTinhomeappliancesshouldincreasedemandformicrocomputers(32-bitARMcores).■Securitycameraproductionhasrecoveredto0.5mnunitspermonth,inlinewiththepeaklastyear(productionhadfallento0.2–0.3mnunitspermonthlatelastyear).Apparently,securitycamerasarebeinginstalledtoimprovepublicsafety.Government-affiliatedmanufacturersareprioritizingtheprocurementofpartsfromnon-UScompanies,minimizingUS-madepartsasmuchaspossible.■DemandislikelytopickupforairconditionersduetoahigherratioofmodelswithinverterssinceOctober.■InIGBT,thereareconcernsaboutlonger-termsupplyshortagesforhigh-voltageunitsinhomeappliancesandautomobiles.■Apparently,toy-relatedandWalmart-relateddemandhasimprovedsomewhatafterweakeningsincelastyearduetoUS-Chinatradefriction(inventorieshavedriedup).■InChina,automotive-relatedandsalesagencydemandisveryweak.Demandrelatedtosolarpowerisalsosluggish.Demandhasbeenslowtostrengthenacrossallindustries,withsomemarketparticipantsabandoningexpectationsfordemandtoimprovein2H2019.

CompaniesMentioned(Priceasof11-Jun-2019)AdvancedMicroDevices,Inc.(AMD.OQ,$32.41)Advantest(6857.T,¥2,873,UNDERPERFORM[V],TP¥1,860)AlibabaGroupHoldingLimited(BABA.N,$162.65)AmazoncomInc.(AMZN.OQ,$1863.7)Anritsu(6754.T,¥1,808,OUTPERFORM,TP¥2,120)AppleInc(AAPL.OQ,$194.81)BYDCoLtd(1211.HK,HK$47.75)BYDCoLtd(002594.SZ,Rmb51.55)Bitmain(Unlisted)CXMT(Unlisted)DISCO(6146.T,¥16,790)DellTechnologies(DELL.N,$54.34)Ericsson(ERICb.ST,Skr92.42)Ericsson(ERIC.OQ,$9.71)FacebookInc.(FB.OQ,$178.1)Ferrotec(6890.T,¥880)Fibocom(300638.SZ,Rmb47.61)Google(GOOAV.OQ^D14)Google(GOOAV.OQ^D14)HiSilicon(Unlisted)Huawei(Unlisted)IntelCorp.(INTC.OQ,$46.85)JEOL(6951.T,¥2,399)JSR(4185.T,¥1,651)Lasertec(6920.T,¥3,980)MediaTekInc.(2454.TW,NT$308.0)MicronTechnologyInc.(MU.OQ,$34.84)MicronicsJapan(6871.T,¥972)Microsoft(MSFT.OQ,$132.1)NVIDIACorporation(NVDA.OQ,$150.75)Nokia(NOKIA.HE,€4.5255)Nokia(NOK.N,$5.16)NuFlareTechnology(6256.T,¥7,040)OrientSemicon(2329.TW,NT$14.7)Powertech(3296.TW,NT$16.9)QUALCOMMInc.(QCOM.OQ,$71.24)Quectel(Unlisted)SCREEN(7735.T,¥4,105)SKHynixInc.(000660.KS,W67,200)SUMCO(3436.T,¥1,258)SamsungElectronics(005930.KS,W44,850)Shin-EtsuChemical(4063.T,¥9,420)Sony(6758.T,¥5,387)SunseaAIoT(002313.SZ,Rmb20.83)TOWA(6315.T,¥809)TaiwanSemiconductorManufacturing(2330.TW,NT$244.5)TencentHoldings(0700.HK,HK$344.6)TexasInstrumentsInc.(TXN.OQ,$112.93)TokyoElectron(8035.T,¥15,975,NEUTRAL,TP¥13,400)TokyoOhkaKogyo(4186.T,¥3,430)TokyoSeimitsu(7729.T,¥2,658)Toshiba(6502.T,¥3,395)ToshibaMemoryCorporation(Unlisted)WINGTECH(600745.SS,Rmb36.59)WalmartInc.(WMT.N,$107.94)WesternDigital(WDC.OQ,$38.41)XiaomiCorporation(1810.HK,HK$9.75)Xilinx(XLNX.OQ,$111.67)YangtzeMemoryTechnologies(Unlisted)oppo(Unlisted)vivo(Unlisted)DisclosureAppendixAnalystCertificationHideyukiMaekawaandYoshiyasuTakemuraeachcertify,withrespecttothecompaniesorsecuritiesthattheindividualanalyzes,that(1)theviewsexpressedinthisreportaccuratelyreflecthisorherpersonalviewsaboutallofthesubjectcompaniesandsecuritiesand(2)nopartofhisorhercompensationwas,isorwillbedirectlyorindirectlyrelatedtothespecificrecommendationsorviewsexpressedinthisreport.

3-YearPriceandRatingHistoryforAdvantest(6857.T)6857.TClosingPriceTargetPriceTargetPriceClosingPrice6857.TDate(¥)(¥)3,500Rating28-Jun-161,122765U10-Mar-172,0121,3902,50029-Jun-171,9641,44018-Aug-171,8401,4701,50020-Nov-172,3351,96025-Apr-182,2492,01050014-Jun-182,4241,93001-Jan-201701-Jan-201801-Jan-201905-Dec-182,3001,860*Asterisksignifiesinitiationorassumptionofcoverage.UNDERPERFORM3-YearPriceandRatingHistoryforAnritsu(6754.T)6754.TClosingPriceTargetPriceTargetPriceClosingPrice6754.TDate(¥)(¥)2,500Rating26-Jul-16628655N2,00009-Nov-1653156520-Apr-177656601,50028-Aug-1785275015-Aug-181,6191,6201,00021-Feb-192,1422,020500*Asterisksignifiesinitiationorassumptionofcoverage.01-Jan-201701-Jan-201801-Jan-2019NEUTRAL3-YearPriceandRatingHistoryforTokyoElectron(8035.T)8035.TClosingPriceTargetPriceTargetPriceClosingPrice8035.TDate(¥)(¥)28,000Rating28-Jun-168,07910,200O23,00010-Mar-1711,91010,500N29-Jun-1715,30013,90018,00018-Aug-1715,15014,00020-Nov-1722,71021,60013,00024-Apr-1819,81519,7008,00014-Jun-1820,05517,60001-Jan-201701-Jan-201801-Jan-201905-Dec-1815,32013,400*Asterisksignifiesinitiationorassumptionofcoverage.OUTPERFORMNEUTRALAsofDecember10,2012Analysts’stockratingaredefinedasfollows:Outperform(O):Thestock’stotalreturnisexpectedtooutperformtherelevantbenchmark*overthenext12months.Neutral(N):Thestock’stotalreturnisexpectedtobeinlinewiththerelevantbenchmark*overthenext12months.Underperform(U):Thestock’stotalreturnisexpectedtounderperformtherelevantbenchmark*overthenext12months.*Relevantbenchmarkbyregion:Asof10thDecember2012,Japaneseratingsarebasedonastock’stotalreturnrelativetotheanalyst"scoverageuniversewhichconsistsofallcompaniescoveredbytheanalystwithintherelevantsector,withOutperformsrepresentingthemostattractive,Neutralsthelessattractive,andUnderperformstheleastattractiveinvestmentopportunities.Asof2ndOctober2012,U.S.andCanadianaswellasEuropeanratingsarebasedonastock’stotalreturnrelativetotheanalyst"scoverageuniversewhichconsistsofallcompaniescoveredbytheanalystwithintherelevantsector,withOutperformsrepresentingthemostattractive,Neutralsthelessattractive,andUnderperformstheleastattractiveinvestmentopportunities.ForLatinAmericanandAsiastocks(excludingJapanandAustralia),ratingsarebasedonastock’stotalreturnrelativetotheaveragetotalreturnoftherelevantcountryorregionalbenchmark(India-S&PBSESensexIndex);priorto2ndOctober2012U.S.andCanadianratingswerebasedon(1)astock’sabsolutetotalreturnpotentialtoitscurrentsharepriceand(2)therelativeattractivenessofastock’stotalreturnpotentialwithinananalyst’scoverageuniverse.ForAustralianandNewZealandstocks,theexpectedtotalreturn(ETR)calculationincludes12-monthrollingdividendyield.AnOutperformratingisassignedwhereanETRisgreaterthanorequalto7.5%;UnderperformwhereanETRlessthanorequalto5%.ANeutralmay

beassignedwheretheETRisbetween-5%and15%.TheoverlappingratingrangeallowsanalyststoassignaratingthatputsETRinthecontextofassociatedrisks.Priorto18May2015,ETRrangesforOutperformandUnderperformratingsdidnotoverlapwithNeutralthresholdsbetween15%and7.5%,whichwasinoperationfrom7July2011.

Restricted(R):Incertaincircumstances,CreditSuissepolicyand/orapplicablelawandregulationsprecludecertaintypesofcommunications,includinganinvestmentrecommendation,duringthecourseofCreditSuisse"sengagementinaninvestmentbankingtransactionandincertainothercircumstances.NotRated(NR):CreditSuisseEquityResearchdoesnothaveaninvestmentratingorviewonthestockoranyothersecuritiesrelatedtothecompanyatthistime.NotCovered(NC):CreditSuisseEquityResearchdoesnotprovideongoingcoverageofthecompanyorofferaninvestmentratingorinvestmentviewontheequitysecurityofthecompanyorrelatedproducts.VolatilityIndicator[V]:Astockisdefinedasvolatileifthestockpricehasmovedupordownby20%ormoreinamonthinatleast8ofthepast24monthsortheanalystexpectssignificantvolatilitygoingforward.Analysts’sectorweightingsaredistinctfromanalysts’stockratingsandarebasedontheanalyst’sexpectationsforthefundamentalsand/orvaluationofthesector*relativetothegroup’shistoricfundamentalsand/orvaluation:Overweight:Theanalyst’sexpectationforthesector’sfundamentalsand/orvaluationisfavorableoverthenext12months.MarketWeight:Theanalyst’sexpectationforthesector’sfundamentalsand/orvaluationisneutraloverthenext12months.Underweight:Theanalyst’sexpectationforthesector’sfundamentalsand/orvaluationiscautiousoverthenext12months.*Ananalyst’scoveragesectorconsistsofallcompaniescoveredbytheanalystwithintherelevantsector.Ananalystmaycovermultiplesectors.CreditSuisse"sdistributionofstockratings(andbankingclients)is:GlobalRatingsDistributionRatingVersusuniverse(%)Ofwhichbankingclients(%)Outperform/Buy*46%(33%bankingclients)Neutral/Hold*39%(27%bankingclients)Underperform/Sell*13%(22%bankingclients)Restricted2%*ForpurposesoftheNYSEandFINRAratingsdistributiondisclosurerequirements,ourstockratingsofOutperform,Neutral,andUnderperformmostcloselycorrespondtoBuy,Hold,andSell,respectively;however,themeaningsarenotthesame,asourstockratingsaredeterminedonarelativebasis.(Pleaserefertodefinitionsabove.)Aninvestor"sdecisiontobuyorsellasecurityshouldbebasedoninvestmentobjectives,currentholdings,andotherindividualfactors.ImportantGlobalDisclosuresCreditSuisse’sresearchreportsaremadeavailabletoclientsthroughourproprietaryresearchportalonCSPLUS.CreditSuisseresearchproductsmayalsobemadeavailablethroughthird-partyvendorsoralternateelectronicmeansasaconvenience.CertainresearchproductsareonlymadeavailablethroughCSPLUS.TheservicesprovidedbyCreditSuisse’sanalyststoclientsmaydependonaspecificclient’spreferencesregardingthefrequencyandmannerofreceivingcommunications,theclient’sriskprofileandinvestment,thesizeandscopeoftheoverallclientrelationshipwiththeFirm,aswellaslegalandregulatoryconstraints.ToaccessallofCreditSuisse’sresearchthatyouareentitledtoreceiveinthemosttimelymanner,pleasecontactyoursalesrepresentativeorgotohttps://plus.credit-suisse.com.CreditSuisse’spolicyistoupdateresearchreportsasitdeemsappropriate,basedondevelopmentswiththesubjectcompany,thesectororthemarketthatmayhaveamaterialimpactontheresearchviewsoropinionsstatedherein.CreditSuisse"spolicyisonlytopublishinvestmentresearchthatisimpartial,independent,clear,fairandnotmisleading.FormoredetailpleaserefertoCreditSuisse"sPoliciesforManagingConflictsofInterestinconnectionwithInvestmentResearch:https://www.credit-suisse.com/sites/disclaimers-ib/en/managing-conflicts.html.Anyinformationrelatingtothetaxstatusoffinancialinstrumentsdiscussedhereinisnotintendedtoprovidetaxadviceortobeusedbyanyonetoprovidetaxadvice.Investorsareurgedtoseektaxadvicebasedontheirparticularcircumstancesfromanindependenttaxprofessional.CreditSuissehasdecidednottoenterintobusinessrelationshipswithcompaniesthatCreditSuissehasdeterminedtobeinvolvedinthedevelopment,manufacture,oracquisitionofanti-personnelminesandclustermunitions.ForCreditSuisse"spositionontheissue,pleaseseehttps://www.credit-suisse.com/media/assets/corporate/docs/about-us/responsibility/banking/policy-summaries-en.pdf.Theanalyst(s)responsibleforpreparingthisresearchreportreceivedcompensationthatisbaseduponvariousfactorsincludingCreditSuisse"stotalrevenues,aportionofwhicharegeneratedbyCreditSuisse"sinvestmentbankingactivitiesTargetPriceandRatingValuationMethodologyandRisks:(12months)forAdvantest(6857.T)Method:Webaseour¥1,860targetpriceonaP/Bof1.6xandFY3/20EBPSof¥1,163.Wederivethemultipleusingthestock"saverageTOPIX-relativeP/BsincetheVerigyacquisitioninApril2012.Wediscountthisbya0.5standarddeviationinviewofdelaysinDRAMtesterinvestmentandanexpectedsharpdeclineinFY3/20profitsandmultiplytheresulting1.4xbythecurrentTOPIXP/Bof1.13x(asofDecember2018).WeexpectFY3/20profitstobeshortofinitialguidanceforFY3/19andseedownsideriskforthesharesasthiscomesintoview.OurUNDERPERFORMratingisbasedonacomparisonofthecompany"spotentialtotalreturnversusourcoverageuniverse.Risk:Riskstoour¥1,860targetpriceandUNDERPERFORMratingforAdvantestinclude(1)anincreaseintesterdemanddrivenbythestartofmassproductionbyChinesememorymakersand/orearlymassproductionofLP

DDR5;(2)increaseddemandforAP/HPClogictesters.TargetPriceandRatingValuationMethodologyandRisks:(12months)forAnritsu(6754.T)Method:Our¥2,120targetpriceisbasedonafairP/Eof24.5xourFY3/21EPSestimateof¥86.24.Our24.5xtargetP/Eisbasedonthestock’s2.0xTOPIX-relativeP/EduringtheearlystagesoftheLTErampupandthecurrentTOPIXP/Eof12.31x.WepreviouslybasedourtargetpriceonafairP/Eof24.0xandouraverageFY3/20–21EEPSof¥84.01,basedonourviewthatsharepriceformationwouldlikelybedrivenbyamixofexpectationsregarding5Gcommercializationandtherealityofcurrentearnings.Wenowhavebettervisibilityon